What Does Paycheck Calculator, Free Payroll Tax Calculator, Online Mean?

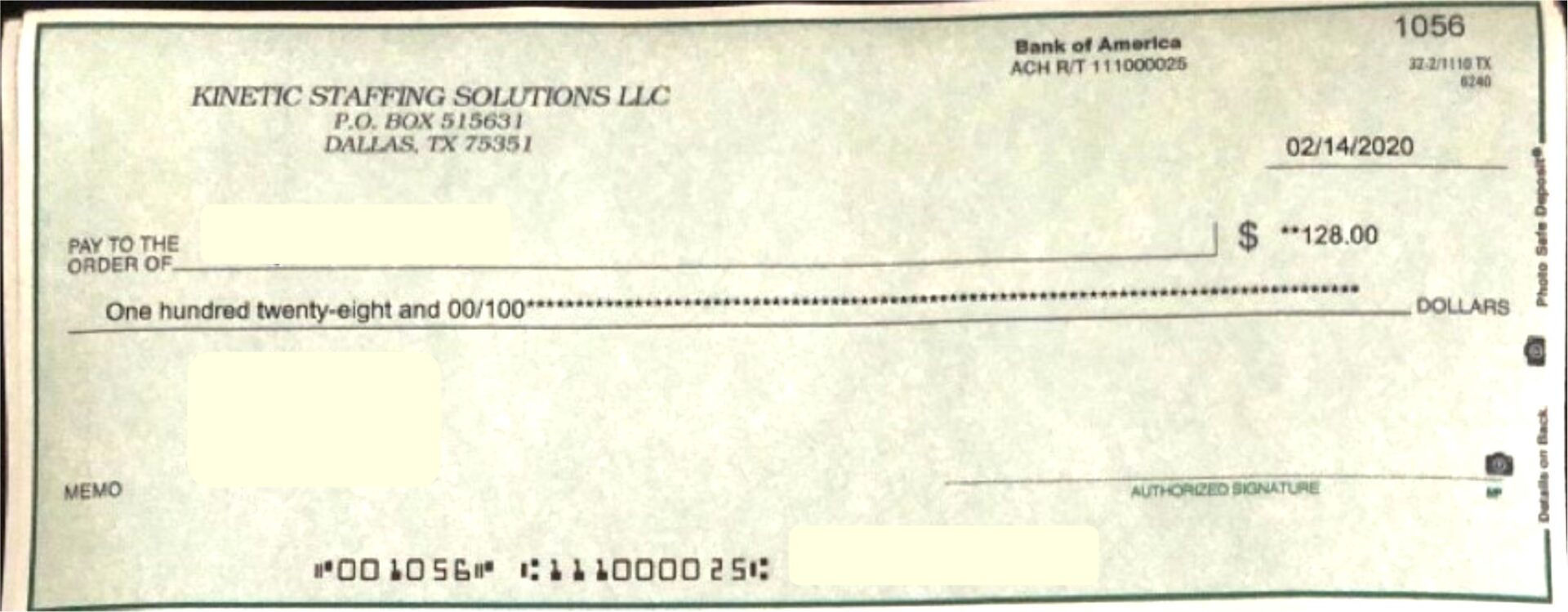

How to Print Paychecks Using Blank Check Stock - Patriot Software

How to Print Paychecks Using Blank Check Stock - Patriot SoftwareThe Single Strategy To Use For View Your Paycheck — Office of Finance / Controller

Many payroll card accounts in the United States are insured by the Federal Deposit Insurance Corporation. Before a business can provide a payroll card to an employee, business should initially contract with a payroll card program manager. The payroll card company performs required "know-your-customer" due diligence as a condition of accepting the application.

For the low price of 17% of your paycheck

For the low price of 17% of your paycheckBusinesses might choose to utilize a payroll card program in order to reduce payroll expense. According to Visa, it costs a company about 35 cents to release pay digitally however two dollars to write a paper paycheck. Payroll warrants [modify] Payroll warrants look like cheques and clear through the banking system like checks and are therefore typically called incomes by their receivers.

Instead they are drawn versus "offered funds" that are not in a bank account so the issuer can postpone redemption. In the U.S., warrants are issued by federal government entities such as the military and state and county governments for payroll to people and for accounts payable to suppliers. Deposited warrants are routed to a collecting bank which processes them as collection items like maturing treasury costs and presents the warrants to the government entity's treasury department for payment each organization day.

Understanding Your Paycheck

Understanding Your PaycheckMy Paycheck - Office of Business and Finance - The Facts

References [modify] (PDF). []"Dodd-Frank: Title X - Bureau of Customer Financial Protection". LII/ Legal Details Institute. (PDF). June 12, 2014. Recovered View Details -08-15. "Glossary of Accounting Terms". Archived from the initial on 2009-03-07. Recovered 2011-03-19.

Picture credit: income tax rates range from 10% approximately a top minimal rate of 37%. The U.S. median family earnings in 2020 was $67,340. 9 U.S. states do not impose their own income tax for tax year 2022. When you begin a brand-new job or get a raise, you'll concur to either a hourly wage or an annual wage.

That's since your employer withholds taxes from each income, lowering your overall pay. Due to the fact that of the many taxes withheld and the varying rates, it can be difficult to determine how much you'll take house. That's where our income calculator is available in. Tax withholding is the cash that comes out of your income in order to pay taxes, with the most significant one being income taxes.