Rumored Buzz on personal finance: Advice, News, Features & Tips - Kiplinger

Best Personal Finance Tips You Should FollowMoney Saving Tips I Wish I Would have known sooner.

Best Personal Finance Tips You Should FollowMoney Saving Tips I Wish I Would have known sooner. 20 Best Reddit Personal Finance Tips - Chime

20 Best Reddit Personal Finance Tips - ChimeExcitement About Personal Finance Tips: Life Kit Episodes On Financial Freedom

Get your free quote here. There are a great deal of strong financial pointers on this list. Don't get overloaded, take a deep breath, and work at your own rate! This Piece Covers It Well might appear confusing, however the material is much easy when you set a speed. Do not rush the process, your financial resources will thank you.

Personal Finance: 22 Expert Personal Finance Tips You Have to Know eBook by Adrienne Leach - 9781386010012 - Rakuten Kobo United States

Personal Finance: 22 Expert Personal Finance Tips You Have to Know eBook by Adrienne Leach - 9781386010012 - Rakuten Kobo United StatesYou don't need a higher-paying job or a windfall from a relative to improve your individual finances. For many individuals, better finance is all it takes to minimize their costs, improve their capability to invest and conserve, and attain financial objectives that as soon as appeared difficult. Even if you seem like your financial resources are stuck in a bad location without any method out, there are a variety of things you can do to develop a better circumstance on your own.

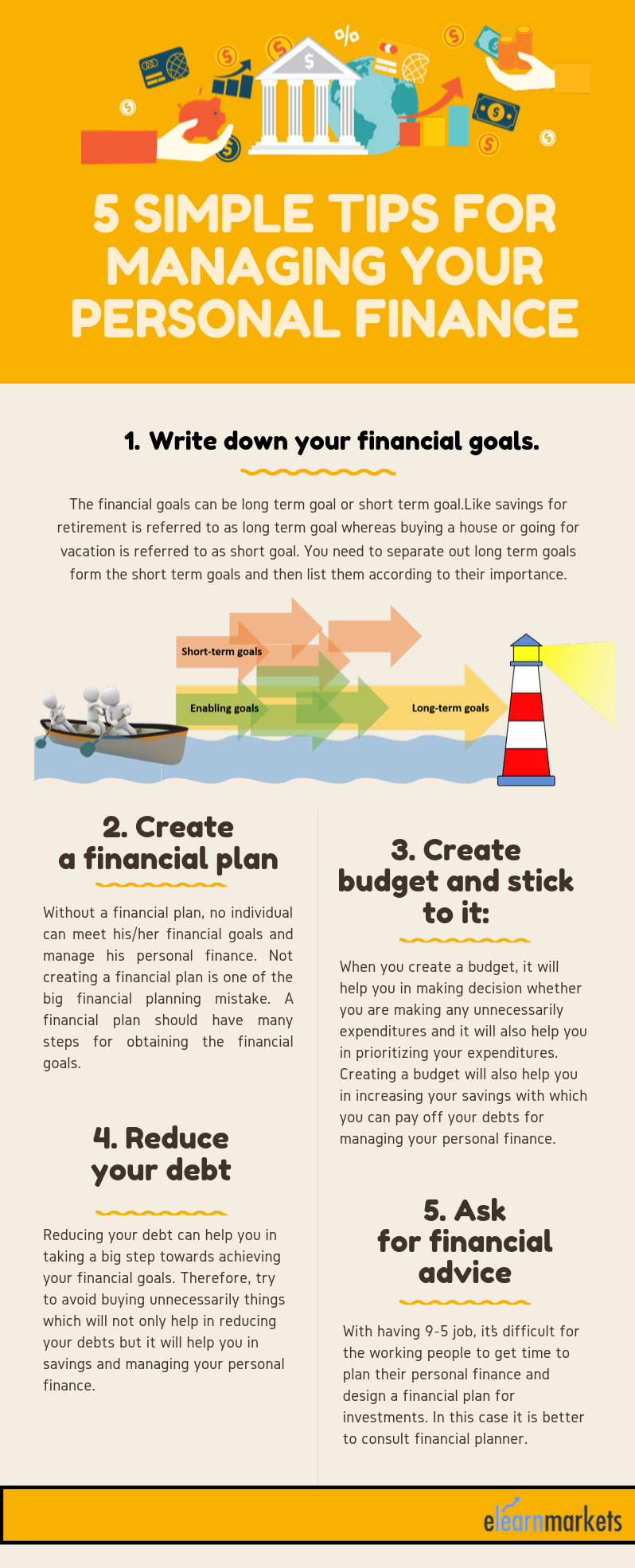

1. Track your costs to enhance your financial resources. If you do not understand what and where you're investing each month, there's a likelihood your individual costs practices have room for enhancement. Much better finance starts with spending awareness. Utilize a cash management app like Cash, Track to track costs across categories, and see for yourself how much you're investing in non-essentials such as dining, home entertainment, and even that everyday coffee.

2. Create a practical monthly spending plan. Use your monthly spending practices, along with your regular monthly net pay, to set a spending plan you understand you can keep. There's no use setting a rigorous spending plan based on extreme changes, such as never ever eating in restaurants when you're currently buying takeout four times a week.

8 Simple Techniques For 10 Personal Finance Books Every College Student Should Read

You should see a spending plan as a way to encourage better routines, such as cooking in the house regularly, but provide yourself a realistic chance at conference this budget plan. That's the only way this finance method will work. 3. Develop your savingseven if it takes some time. Produce an emergency fund that you can dip into when unpredicted circumstances strike.

You must also make general savings contributions to strengthen your monetary security in the event of a job loss. Usage automated contributions such as FSCB's pocket modification to grow this fund and strengthen the routine of putting away cash. 4. Pay your expenses on time each month. Paying costs on time is an easy method to handle your money carefully, and it features exceptional advantages: It helps you prevent late fees and prioritizes essential costs.