Some Known Details About "Counting Costs: Assessing the Financial Toll on Banks Amidst a Slumping US Housing Market"

Survival Methods: How Financial institutions are Adapting to Survive in an Negative US Housing Market Climate

The US property market is a vital field of the economic situation, and its functionality substantially impacts the overall financial stability of the country. Nevertheless, there are times when the casing market experiences undesirable disorders, such as an financial slump or a decrease in demand for housing. Throughout these tough times, banking companies and financial companies need to adjust their strategies to make it through and navigate by means of the hurricane.

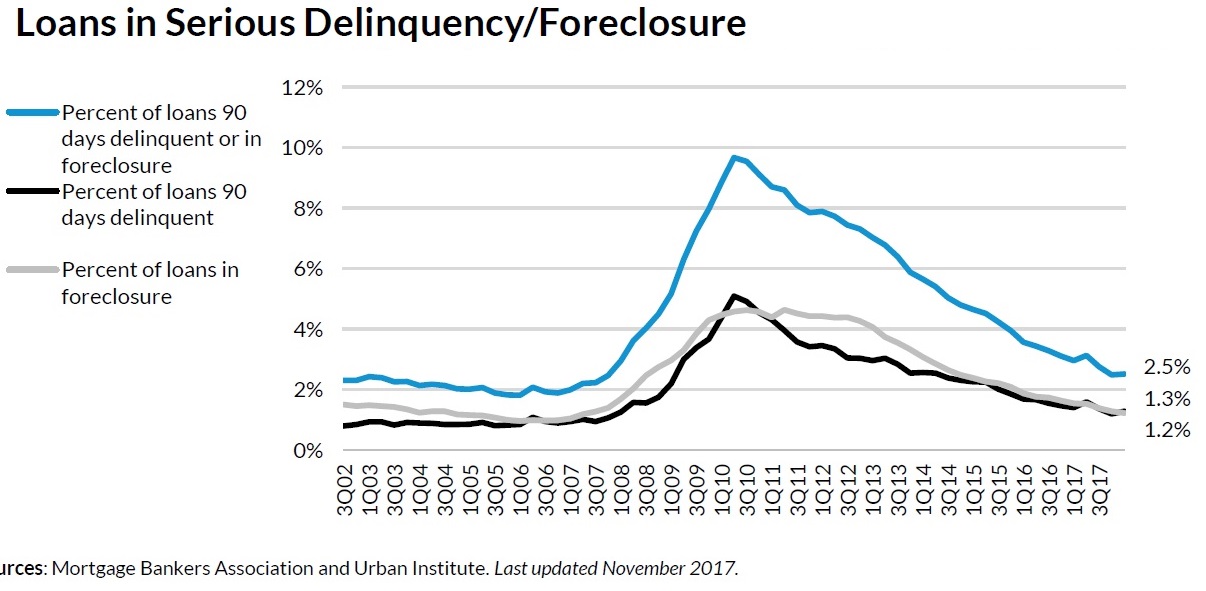

In an negative real estate market weather, banking companies experience a number of obstacle. One of the major problems is the rise in mortgage defaults and repossessions. When homeowners struggle to create their mortgage loan repayments due to work losses or decreasing residential or commercial property market values, it places a pressure on financial institutions' balance slabs. To respond to this difficulty, banking companies have applied numerous survival methods.

1. Securing lending specifications: Financial institutions have become more watchful regarding who they provide money to. They have tightened their lending standards to ensure that debtors possess a higher probability of repaying their mortgage loan fundings. Through doing therefore, they minimize the danger of nonpayments and property foreclosures down the series.

2. Transforming earnings flows: To reduce threats affiliated along with an undesirable housing market weather, banks are concentrating on transforming their earnings streams beyond standard home loan lending. They are discovering various other places such as assets banking, wealth monitoring companies, and insurance policy products to produce additional revenue.

3. Cultivating ingenious financing adjustment systems: Financial institutions understand that assisting straining house owners remain in their residences help each parties involved. Lots of banks have established finance adjustment programs that permit debtors to renegotiate the phrases of their mortgages by reducing interest costs or expanding loan lengths. This aids individuals prevent property foreclosure while additionally lessening reductions for financial institutions.

4. Reinforcing danger monitoring strategies: In unsure opportunities, it becomes important for financial institutions to boost their danger management strategies. By very closely keeping an eye on credit score risks affiliated along with home loan portfolios and improving stress testing styles, banking companies may proactively identify potential problems and take needed procedure to mitigate them properly.

5. Collaborating along with authorities effort: Financial institutions commonly work in collaboration with federal government initiatives aimed at stabilizing the real estate market in the course of tough times. For case, financial institutions may take part in plans that supply refinancing options or deliver monetary support to having a hard time individuals. These collaborations aid financial institutions browse by means of an undesirable real estate market temperature while sustaining efforts to support the general economy.

6. Taking advantage of innovation: Modern technology participates in a critical part in assisting financial institutions adapt and make it through in the course of demanding opportunities. Several financial institutions are putting in in digital change, allowing them to improve operations, decrease costs, and improve consumer take ins. On-line home mortgage application methods and remote financial companies are instances of how modern technology makes it possible for financial institutions to carry on providing customers effectively also when experienced along with unfavorable market ailments.

7. Increasing in to brand new markets: When the US property market is encountering challenges, banks might opt for to check out chances in other locations or nations where the real property market is more positive. Through broadening their existence worldwide, banking companies can easily diversify their profiles and lessen reliance on a singular market.

8. Enriching customer help: Financial institutions recognize that maintaining strong partnerships with consumers is essential for long-term survival and results. As a result, they focus on offering excellent client assistance by giving personalized insight, support along with monetary program, and positive communication relating to possible risks or adjustments in mortgage loan conditions.

Making it through an bad US property market environment requires durability, versatility, and key thinking from financial institutions. Through applying Also Found Here - firming up lending requirements, diversifying profits streams, building impressive loan adjustment systems, building up risk monitoring methods, teaming up along with government initiatives, accepting technology, increasing in to brand-new markets, and boosting client help - economic institutions can easily get through through challenging times while guarding their very own security as properly as that of the overall economic climate.

In final thought,

the US real estate market's functionality greatly affect the financial stability of the nation.

In the course of negative health conditions,

banking companies deal with obstacle such as home mortgage defaults and foreclosures.

To survive, banks have tightened lending standards,

diversified profits flows,

created ingenious financing alteration systems,

strengthened risk management techniques,

collaborated with government campaign,

took advantage of modern technology,

extended into new markets, and

enhanced customer assistance.