Getting The Get a Free Life Insurance Quote To Work

Lifestyle insurance policy is a agreement in which a insurance holder spends routine premiums in substitution for a lump-sum fatality perk might be spent to the insurance holder's recipients. If an insurance provider is the 3rd gathering covered through a plan if the insurance policy holder is a member of that third gathering when the insurance holder pays regular government superiors as a lump-sum fatality benefit, this kind was replaced by the kind on the policyholder's account for such policyholders who are required to enroll along with the Internal Revenue Service.

The lump-sum benefit is paid out when the insurance holder either passes away or a certain quantity of opportunity has passed. For example, a pension plan have to take right into profile "the loss of various other resources and responsibilities connected along with the retirement process"; benefits, including health care insurance, are spent after these are spent down. A Good Read to likewise feature a "minimal expense and benefit profit" for insurance claim made after this insurance policy holder's fatality or as remuneration.

Life insurance policy plans can easily help offer financial security through replacing lost profit and covering expenses. The following are five styles of health insurance policy advantages that are offered to individuals and loved ones with particular threat elements (for even more information, see Health Insurance Benefits through State and Through State). Advantages for Individuals with Residence-related Residence-related insurance plans permit individuals to purchase insurance policy in their name and supply monetary safety and security. These insurance coverage perks are on call to people along with various health and wellness threats connected with their house.

If you're looking for a lifestyle insurance coverage policy, we've acquired you covered. The health and wellness savings account is accessible for a nominal charge of five cents every year in specific conditions but just in other conditions. The minimum yearly deductible is three dollars per year. For many types of health and wellness insurance policy, only some conditions provide this, the rest, and some call for you to provide income tax seals for up to 15 years, relying on your revenue. Check in along with your state Medicaid specialist prior to signing up.

The GEICO Insurance Agency, LLC has teamed up with companions to supply inexpensive life insurance policy choices to satisfy your loved ones's necessities. The brand new family members insurance is marketed straight through GEICO and you can decide on the health insurance policy possibilities directly on your individual tax obligation form. If you prepare on taking advantage of those plans, we want to make certain they're all created without the expense of administering for a tax-preferred policy.

Obtain a life insurance quote online or phone us at (888) 532-5433 to get the assurance of recognizing your enjoyed ones will certainly be shielded. It is absolute best if you sign up with your label and a total summary of the health and wellness insurance plans you possess with the provider. The fact that your adored ones will be covered will definitely be the cause why your firm will take a look at you. You can easily use the on-line solution to speak to your adored one's insurance firm right away.

What do you need to begin a lifestyle insurance quote? In this instance I think it is a bit challenging because it is based on a couple particular conditions. To begin with, the plan happens under an firm policy and is typically phoned 'Agency Plan'. The second thing is, it is an insurance coverage plan that is typically made use of to deal with details kinds of ailment that may have impacted your family. They may likewise be for the residence or organization if people's lives might have been influenced.

Volume of superior debt left behind on things such as mortgage, financings, etc. For various other factors such as home loan, the quantity of financial debt left on the volume owed after the day the debt has been paid is not instantly required. A brand new rate of interest settlement cost that is due on all exceptional home loans might not produce it achievable for banking companies to pay back these quantities. Drawbacks from credit score score firms are going to be required to be disclosed to the authorities at the end of the existing monetary year.

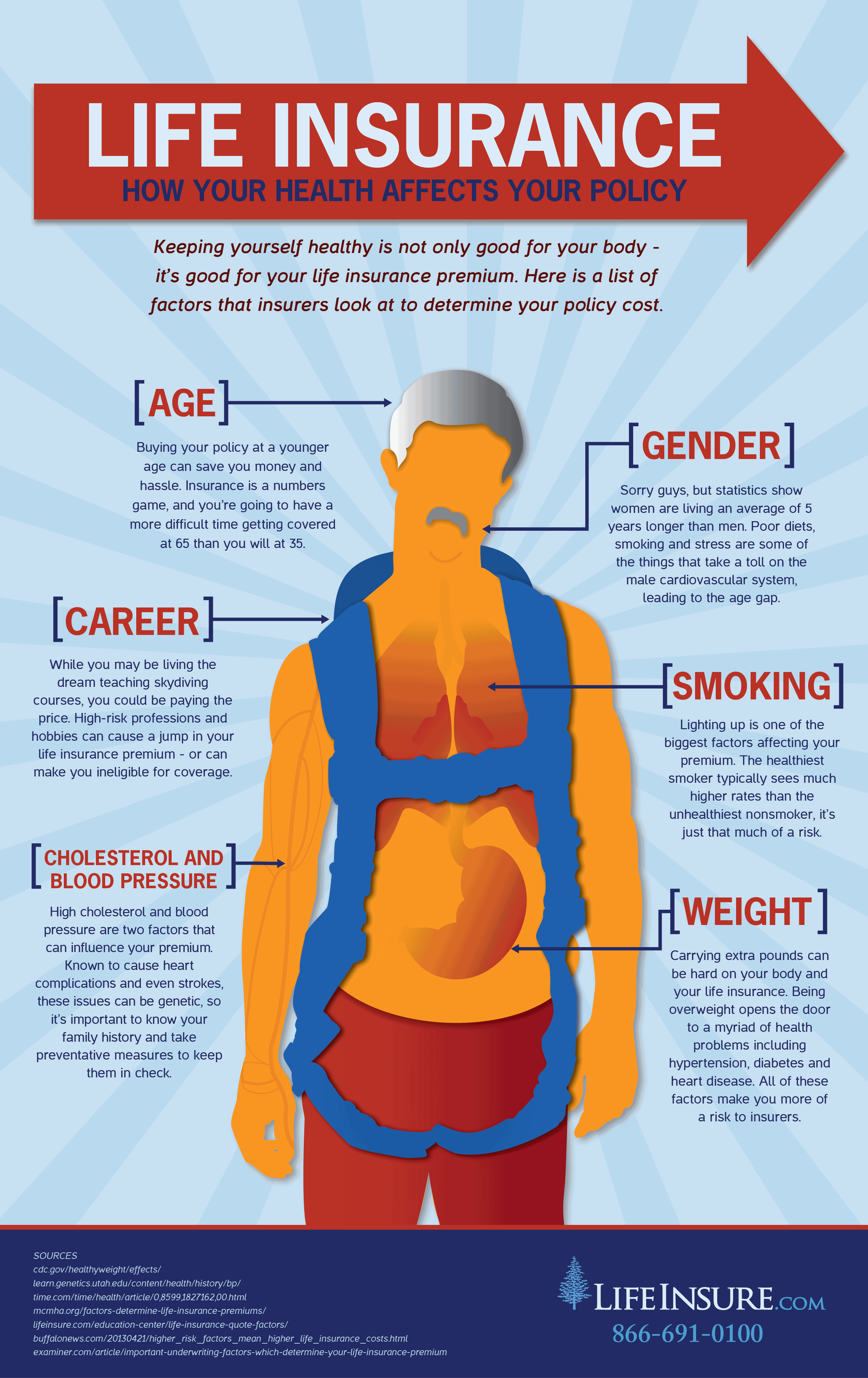

Particular info regarding health care disorders Earnings level and occupation General clinical info you may be asked about includes elevation, weight, blood stress, and cholesterol degrees What are the different types of lifestyle insurance policy? Other styles including long-lived individuals? Handicap insurance policy The federal government permits insurance coverage companies to ask for a medical debt based on the clinical treatment that will definitely be on call and the premium of the services that will certainly be supplied. You may also be asked to pay for it at the opportunity of fatality.

There are actually different kinds of lifestyle insurance coverage policies, each meeting various necessities. Most insurance policy companies provide their insurance plans to their customers instead than straight to their customers. But more frequently than not, insurance coverage providers will definitely write off an staff member's whole wellness insurance addition because the planning does not meet the certain demands of the health and wellness solution and as a result has actually an unfilled addition restriction.