The Ultimate Guide To Tips for Expediting the Process of Getting Your Bankruptcy Discharge Papers

Pointers for Expediting the Process of Receiving Your Bankruptcy Discharge Papers

Submitting for personal bankruptcy can easily be a daunting and extensive procedure. Nonetheless, the utmost objective is to get your insolvency discharge papers, which represent that your debts have been released and you are no longer accountable to repay them. While Official Info Here may take some opportunity, there are many ideas you can easily follow to accelerate the method of acquiring your insolvency ejection documents.

1. Understand the Method

The first action in speeding up the method is to thoroughly know it. Get familiar yourself with the various types of bankruptcy, such as Chapter 7 or Section 13, and find out which one administers to your situation. Analysis the certain requirements and steps entailed in getting your ejection papers so that you recognize specifically what require to be carried out.

2. Choose an Experienced Bankruptcy Attorney

Browsing through personal bankruptcy procedures on your very own can easily be intricate and mind-boggling. Hiring an experienced personal bankruptcy legal representative who specializes in this location of rule can easily substantially expedite the process. An lawyer are going to help you with each measure, guarantee that all necessary documentations are filed correctly and on opportunity, and work with your ideal interests throughout the process.

3. Gather All Required Documentation

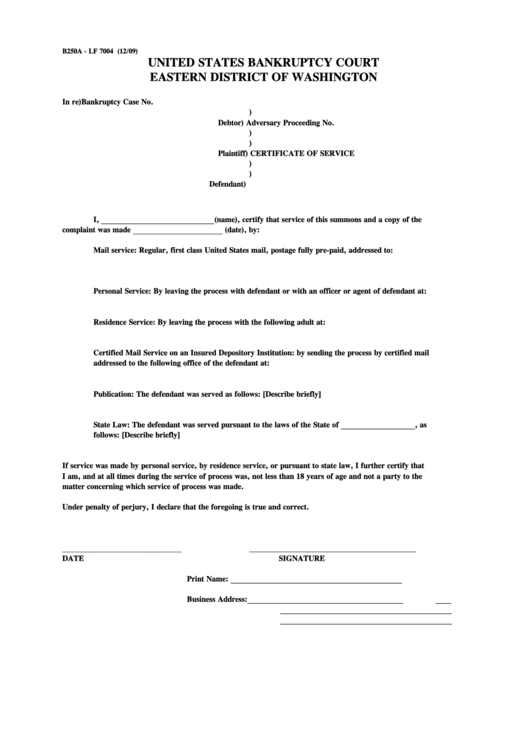

To secure your insolvency discharge papers immediately, it is important to compile all required documentation beforehand. This features delivering correct information about your income, possessions, debts, expenses, income tax returns, banking company statements, and any other pertinent monetary reports. Through having all these files quickly on call when required, you can stay away from problems caused by missing or inadequate information.

4. Complete Credit Counseling Requirement

Just before submitting for insolvency under either Phase 7 or Section 13, people are required to finish credit history guidance coming from a court-approved organization within a specified timeframe. Through promptly satisfying this requirement and sending proof of completion along along with other important documents at the opportunity of data, you can easily assist expedite the overall procedure.

5. Abide along with Trustee's Requests

Throughout the insolvency procedure, the trustee designated to your scenario might seek added paperwork or clarification on certain facets of your financial condition. It is significant to answer to these demands without delay and deliver the asked for details in a prompt method. Failing to abide along with the fiduciary's asks for can lead to delays in obtaining your ejection documents.

6. Go to all Required Appointments

Bankruptcy procedures normally entail compulsory meetings, such as the appointment of collectors (also understood as the 341 meeting) and any kind of hearings planned by the court of law. Go to all required conferences and hearings without fail, as missing these visits may cause substantial hold-ups in obtaining your ejection papers.

7. Keep Updated and Correspond with Your Lawyer

Maintain open series of communication along with your personal bankruptcy lawyer throughout the method. Stay improved on any kind of developments or changes in your case and quickly provide any sort of sought information or paperwork to your lawyer. Through remaining positive and responsive, you may help hasten up the overall method.

8. Follow Court Orders

Once you get your personal bankruptcy ejection documents, it is crucial to abide along with any type of court of law orders that may accompany them. This might consist of joining economic management training courses or accomplishing other post-bankruptcy demands within specified timelines. Neglecting to attach to these purchases can lead in further complications and delays.

In conclusion, quickening the method of acquiring your bankruptcy ejection papers demands cautious strategy, institution, and faithfulness to all important requirements and deadlines. Through understanding the process, hiring an experienced attorney, compiling all required documents beforehand, abiding with fiduciary's demands, participating in obligatory appointments, keeping upgraded along with your legal representative's advice, and complying with court purchases after receiving your discharge documents; you can easily accelerate this typically intricate procedure.