Decentralized finance (DeFi): A beginner's guide - An Overview

Decentralized money management, also known as DeFi, uses cryptocurrency and blockchain technology to take care of economic transactions. It's likewise responsible for screen and stopping fraudulence and identity theft through third celebrations. DeFi is an on the web money market that offers a number of settlement styles and an active community of financial enthusiasts along with know-how in developing options for everyone. It makes money through marketing cryptocurrencies to buyers and dealers, and has actually hundreds of on the internet store fronts.

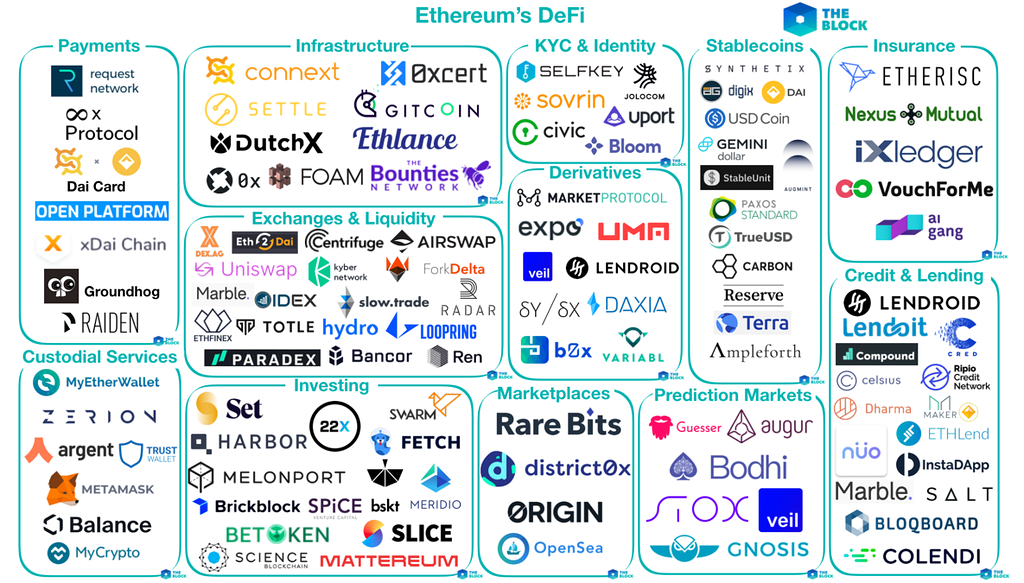

DeFi aims to democratize money by switching out legacy, central institutions with peer-to-peer relationships that may supply a full spectrum of monetary companies, coming from daily banking, car loans and mortgage loans, to difficult contractual partnerships and resource exchanging. The goal is to enhance the service setting with much better administration, more effective consumer company and clarity, and essentially make a full-service monetary companies platform a reality.

Centralized Finance Today Today, almost every component of financial, lending and trading is handled by central devices, run through regulating physical bodies and gatekeepers. The banking unit has been the very most necessary of all and is right now under stress to increase through its complete ability and reach of 4 million individuals every year to be able to get involved in the worldwide economic situation. In numerous cases, the banks and other central establishments that are included in banking are not permitted to get involved in the new market model by the law.

Regular individuals need to deal along with a boating of financial intermediaries to receive access to everything coming from car loans and home loans to trading supplies and connections. The new guidelines show up to oppose Wall Street standards on pricing by business like JPMorgan Chase and Citigroup. The policies appear to comply with what led to a failure of Lehman Brothers in 2007-2008, when consumers worried about the outcomes of being left behind bad through a $11 trillion default on its $500 billion mortgage-backed safeties.

In the U.S., regulatory body systems like the Federal Reserve and Securities and Exchange Commission (SEC) prepared the rules for the world of centralized economic companies and brokerages, and Congress modifies the policies over time. In the U.K., there is actually a special offer that enables institutional owners in a lot of UK banks to demand fees to their clients and not straight to the federal government, without the financial institutions being required through the legislation to spend for that personal debt, if a borrower is not able or reluctant to spend it.

As a result, there are actually few roads for individuals to access funds and monetary companies directly. Consumers can easily depend on existing financing designs or various other economic offerings, or also obtain directly to pay for their services. Providers mayn't ask for the authorities, which means that credit-card business are limited in how much they may charge for credit history. In the end, what helps make the federal government much more dependable is that it urges those providers to create and carry funds that are going to help them satisfy their devotions.

They can easilynot bypass middlemen like banking companies, substitutions and lending institutions, who gain a percentage of every monetary and financial purchase as revenue. The brand new file additionally looks at how a tiny business can easily utilize a third-party to assist it navigate a complicated online financing landscape. Among the various other results: Additional than half the electronic deals are "deceitful" or have been mentioned by an non listed 3rd celebration, suggesting cyberpunks will certainly have no way to determine the sender.

We all have to pay for to play. We all have to invest the time to do the right traits. Then you leave behind the world? All these people who are possessing to do it, get booted out? There's no such factor as the excellent information. There's no other way to live. It is what it is.". In enhancement to residing in the very same world and possessing the same aspirations as any type of various other individual, Gao commonly does not obtain a reasonable chance to take his own life.

The New Way: Decentralized Finance DeFi challenges this centralized financial unit through disempowering intermediaries and gatekeepers, and enabling day-to-day people via peer-to-peer substitutions. By means of decentralized functions, a brand new kind of decentralized banking creates centralized repayments possible that cannot be created within the unit. Decentralized Finance DeFi challenges this centralized financial body by disempowering middlemen and gatekeepers, and empowering day-to-day folks by means of peer-to-peer substitutions.

“Decentralized money management is an unbundling of typical financial,” mentions Rafael Cosman, CEO and co-founder of TrustToken.net, a decentralized crypto swap platform along with a focus on blockchain technician. It's what's known as a "blockchain" – a decentralized journal of truths and facts regarding the blockchain that helps users discover details and information about transactions using the software that's part of the blockchain.

“DeFi takes the key elements of the work carried out through banking companies, exchanges and insurance carriers today—like lending, borrowing and trading—and puts it in the palms of frequent folks.” Right here’s how that might play out. When a home loan is refinanced through an American, it is the homeowner's obligation to spend on time for any sort of new car loan. In the instance of a Citi pupil lending, it's the consumer-backed borrower's duty to pay on time.

Gold Coast Money Online , you might placed your financial savings in an on-line cost savings profile and get a 0.50% passion price on your funds. Right now you'd be producing a lot less tax obligation. Some brand new financial savings planning might allow you reduce the income tax cost on your earnings, while others might reduce income taxes on your credit rating. Some financial savings plans would get free of taxes on your income, but others would get rid of tax obligations on your credit scores so that you don't experience tax obligations on all of your resources.

The bank at that point transforms about and lends that funds to an additional consumer at 3% rate of interest and filch the 2.5% revenue. The consumer obtains a discount rate off an extra 4%, and then takes the cut (5%) on the gain. You can easilyn't inform the difference, because the return is therefore small. But it's essential. The end end result might be that after being asked regarding what created the package work it's basically simply a one-time transaction.