Cold Stone Creamery Franchise Opportunity Available in Can Be Fun For Everyone

How NYC Faces a Lasting Economic Toll Even as the Coronavirus Pandemic Passes - The New York Times

How NYC Faces a Lasting Economic Toll Even as the Coronavirus Pandemic Passes - The New York TimesThe smart Trick of Smash My Trash locations in New York City - Dumpster Waste That Nobody is Discussing

Fransmart's existing and past franchise development portfolio brand names have opened countless restaurants worldwide. Fransmart and their partner brands are committed to franchise advancement growth. Follow Fransmart on Facebook, Linked, In, Instagram, Twitter and You, Tube. To learn more, see www. fransmart.com. Key Reference @fransmart. com703-842-5400.

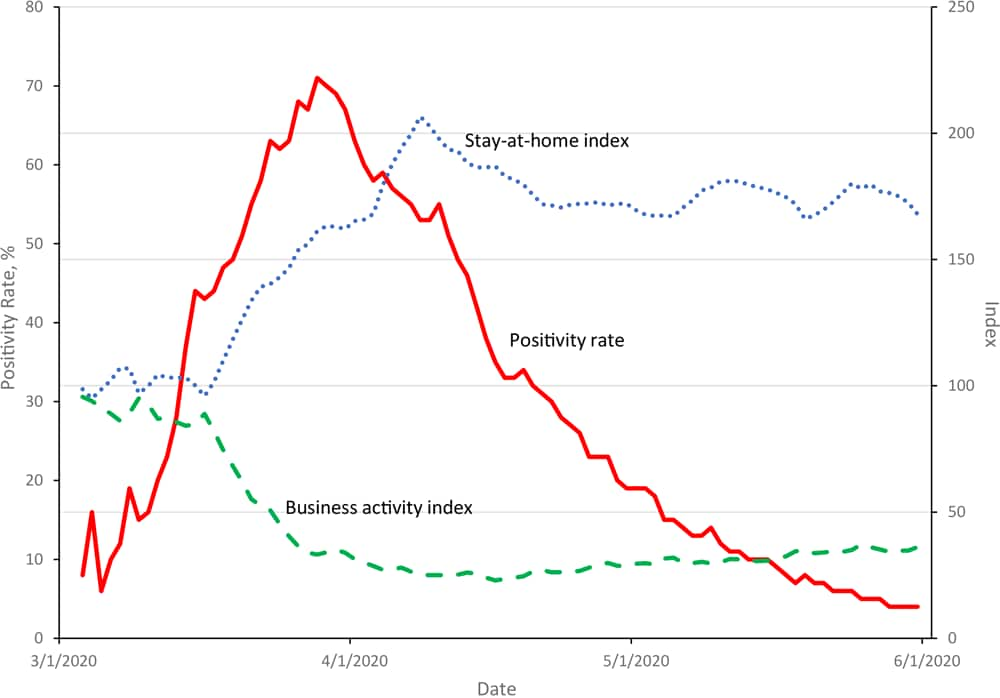

Business Closures, Stay-at-Home Restrictions, and COVID-19 Testing Outcomes in New York City

Business Closures, Stay-at-Home Restrictions, and COVID-19 Testing Outcomes in New York CityBackground Domestic corporations (corporations created under the laws of New York State) should pay earnings franchise and other taxes to New York State. The corporation pays the earnings franchise tax in exchange for the advantage of exercising its corporate franchise, doing company, employing capital, owning or leasing residential or commercial property, maintaining an office, or deriving receipts from activity in the state.

Certify with the City - SBS

Certify with the City - SBSThe procedure of voluntary dissolution brings the existence of the corporation to an end, and gets rid of the corporation's commitment to submit returns and pay taxes and costs to New York State in the future. The dissolution process involves both the Tax Department and the New York Department of State. A domestic corporation that willingly liquifies does not end its obligation to file returns and pay taxes and fees if it continues to perform business, even if business is continued totally outside New york city State.

See This Report on The Fastest Growing Small Businesses in NYC - The Farm Soho

Treatment for voluntary dissolution Voluntary dissolution is typically a two-step procedure: Getting composed consent from the Tax Department1 (which will check to see if the corporation owes back taxes and if it has submitted all its returns)2; and Filing documentation with the New York Department of State, including a Certificate of Dissolution.