9 Easy Facts About Castaldi vSignature Retail Services, Inc- Casetext Shown

The Ultimate Guide To SB334 - Modifies provisions relating to service territories of

This possible breadth in application is necessary since, while the RPAA is linked by numerous to the rollout of Payment Canada's real-time retail payment system, the proposed Act includes no such restrictive language. Exemptions The following are significant exemptions from payment functions regulated under the RPAA: those associated to closed loop present cards and pre-paid cards, provided they are issued by a merchant or a party that is left out from the RPAA.

The RPAA suggests that extra exclusions may be consisted of in the policies. It is interesting to keep in mind that the list of excluded entities does not mirror the list of entities that are either obligatory or entitled members of Payments Canada. For example, "insurance coverage business" are not all entitled to membership in Payments Canada.

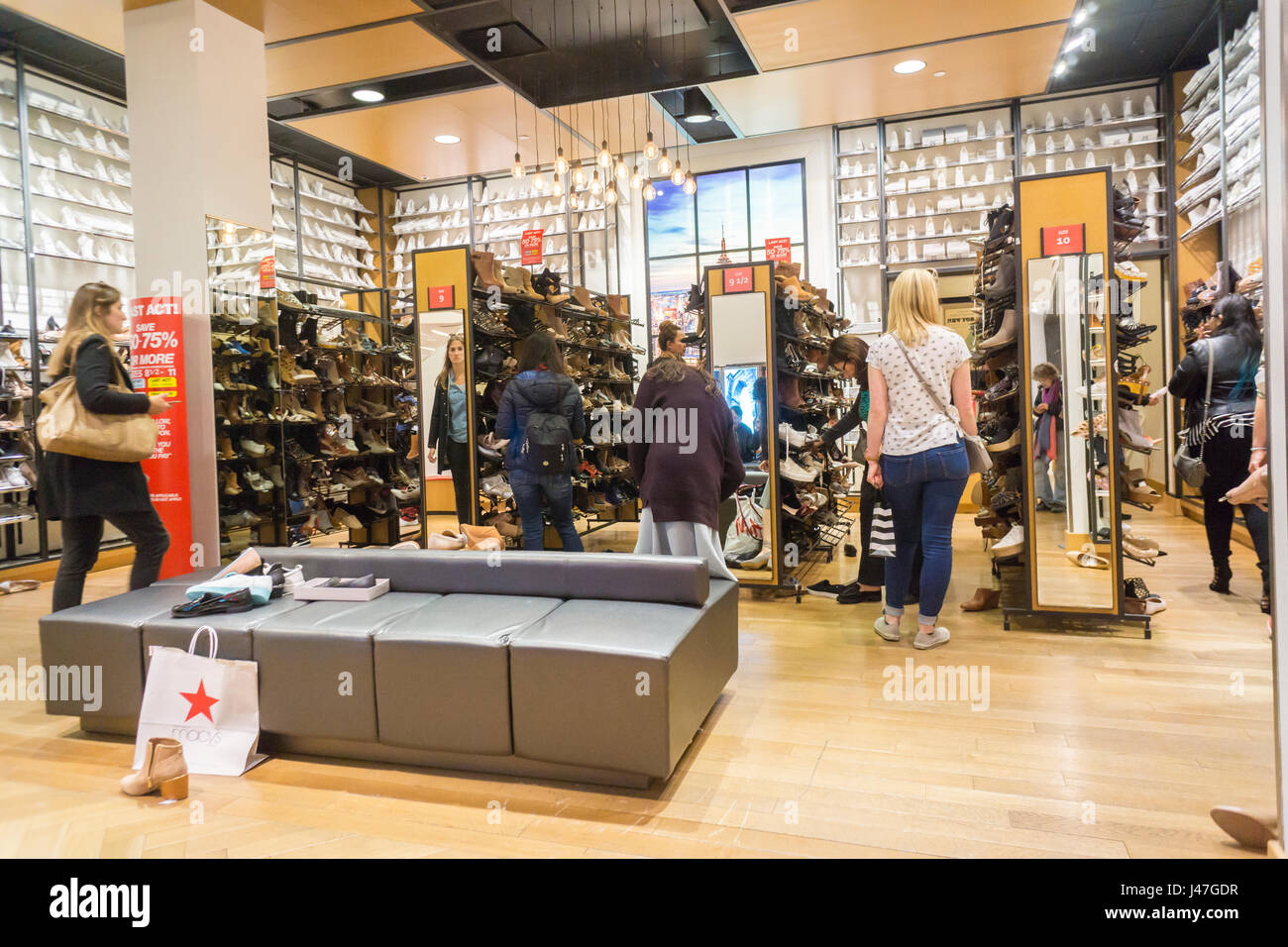

How to Act Like a Darling D2C Brand

How to Act Like a Darling D2C BrandSimilarly, securities dealers are entitled to Payments Canada subscription, but are not presently listed as left out from the scope of the RPAA. While membership criteria in Payments Canada is being considered by the Department of Finance, definitive modifications have actually not been made. Who is Also Found Here ? Interestingly, the Bank of Canada ("Bo, C") will be the regulator accountable for ensuring that entities abide by requirements under the RPAA.

Especially, this includes a failure to register as a money services organization. A PSPs registration may be revoked where they have actually been served with a notice of infraction for devoting a "serious" or "very major" violation under the PCMLTFA. Functional threat management and event action structure A PSP is required to develop an operational risk management and event reaction framework to determine and alleviate functional dangers, and react to "occurrences"; specifically, events that could result in the "decrease, wear and tear or breakdown" of any retail payment activity.

6 Simple Techniques For Sales Exemptions Under the FLSA - Practical Law - Westlaw

The RPAA makes it clear that in case a PSP becomes conscious of an event that has a product effect on an (a) end user, (b) PSP, and (c) cleaning house of a clearing and settlement system (as defined in the PCSA), the PSP will be needed to alert the Bo, C.

Effective mitigation of PSPs' functional danger will be essential to preserving rely on any payment system that permits PSP participation. The RPAA presently provides scant detail on the operational danger management framework; further evaluation will have to be scheduled pending the release of the draft RPAA policies. Protecting end-user funds There are additional requirements for PSP that holds end-user funds as a retail payment activity.

Retail brands need to act less like a retailer and more like a service brand

Retail brands need to act less like a retailer and more like a service brandThe PSP needs to likewise be guaranteed or guarantee an amount equal to higher than the quantity held in the account. Exceptions exist for deposit taking institutions under certain scenarios. These requirements are similar to those in place for electronic cash organizations ("EMIs) developed by the Payment Service Directive EU 2015/2366 ("PSD2") and executed by numerous national authorities.

Valvoline Names New President of Retail Services - NOLN

Valvoline Names New President of Retail Services - NOLNThere is still work to be done on crucial issues like operational threat management, and end user protection. We will be following further developments carefully. A special thank you to Noah Walters, articling trainee, for his support in the preparation of this post.

The Buzz on Chapter 255D - Massachusetts Legislature

This page was updated1 month ago Telecommunications Act gives us powers to enhance retail service quality (RSQ) consisting of customer service, faults, installation, agreements, item disclosure, billing, changing, service performance, speed and accessibility. These arrangements direct us to keep track of RSQ and make that information offered in such a way that notifies customer choice.