The smart Trick of Capital Gains Tax on Home Sales - Investopedia That Nobody is Discussing

Two Phases of Exclusion Process to Keep Wildlife and Rodents Out of Your Home - World Class Wildlife Removal & Rodent Remediation

Two Phases of Exclusion Process to Keep Wildlife and Rodents Out of Your Home - World Class Wildlife Removal & Rodent RemediationSelling Rental Property That Was a Primary Home - Roofstock Things To Know Before You Get This

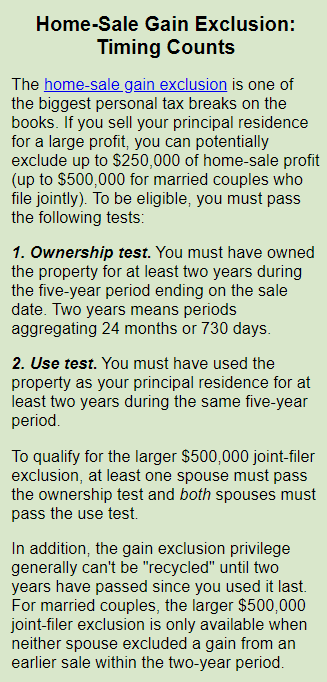

If a taxpayer owns 2 homes during the five-year period, both might receive the exclusion if the taxpayer uses each of them as a primary house for a minimum of 2 years during the five-year duration. Nevertheless, as talked about below, Certified public accountants will discover that normally the gain on just one of the 2 otherwise certified houses can be omitted during any two-year period.

David resides in the Kansas house throughout 2000, 2001 and 2004 and in the Texas home throughout 2002 and 2003. David's principal house for 2000, 2001 and 2004 is the Kansas residential or commercial property. His principal home for 2002 and 2003 is the Texas house. If David chooses to offer among the houses during 2004, both receive the gain exclusion because he owned and utilized every one as a primary residence for at least 2 years during the five-year period before the sale date.

Rodent Exclusion Tips - Get Ready for the Season - Catchmaster Pro

Rodent Exclusion Tips - Get Ready for the Season - Catchmaster ProHowever, short short-term lacks, such as vacations, are counted as durations of usage even if the house is leased throughout that time. On January 1, 2000, Elvira purchased and began to reside in a house. During View Details and 2001, Elvira went to England for June and July on trip. She sells the home on January 1, 2002.

Therefore, Elvira is eligible for the gain exemption. If, nevertheless, Elvira had actually invested June 1, 2000 to June 1, 2001 in England, she would not be eligible for the gain exclusion due to the fact that an one-year lack is not treated as a short momentary one. In the latter case Elvira used the home for only 12 months throughout the five-year period ending on the date of sale.

The Only Guide to Exclusion of Gains from Sale of Personal Residence

Delaying the sale up until a taxpayer has fulfilled those requirements might lead to considerable tax cost savings. Documenting the time invested at a house is essential for anybody owning more than one since just the primary house is qualified for the gain exclusion. To figure out which home qualifies as the taxpayer's principal house, the IRS is most likely to make its basic questions.