Our Tips for buying a house • Asheville, NC Real Estate Diaries

Some Of 8 Quick tips to lower your home buying costs - 2021 - The

A displaced housewife who has actually only owned with a partner. A person who has actually just owned a principal home temporarily affixed to a permanent structure in accordance with appropriate policies. An individual who has actually only owned a home that was not in compliance with state, regional, or design structure codesand that can not be brought into compliance for less than the expense of building an irreversible structure.

Ten Tips to Consider When Buying a Home in Dallas/Fort Worth

Ten Tips to Consider When Buying a Home in Dallas/Fort Worth 10 Best-Kept Secrets for Buying a Home - HGTV

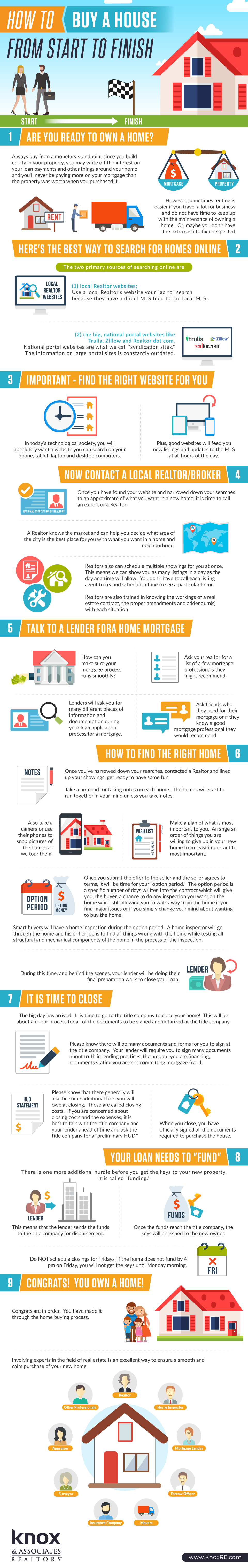

10 Best-Kept Secrets for Buying a Home - HGTVMaybe you're simply looking to change all those "lost" rent payments into home mortgage payments that offer you something tangible: equity. Or possibly you see homeownership as a sign of independence and delight in the concept of being your own property owner. Also, buying a house can be a great investment. Narrowing down your big-picture homeownership goals will point you in the best direction.

How's your financial health? Before clicking through pages of online listings or falling in love with your dream house, do a major audit of your finances. You need to be gotten ready for both the purchase and the continuous expenditures of a house. The outcome of this audit will inform you whether you're prepared to take this big action, or if you need to do more to prepare.

8 Things Not To Do In Your Quest To Buy A House Infographic - Home buying, Home buying process, Real estate infographic

8 Things Not To Do In Your Quest To Buy A House Infographic - Home buying, Home buying process, Real estate infographicA Biased View of 5 Tips for Buying a Home This Summer - Money

When you buy a house, there will be substantial up-front costs, including the deposit and closing expenses. You need cash put away not only for those expenses but likewise for your emergency situation fund. Lenders will need it. One of the greatest obstacles is keeping your cost savings in an accessible, relatively safe lorry that still offers a return so that you're keeping up with inflation.

It's not going to make you rich, but you aren't going to lose money, either (unless you get struck with a charge for squandering early). The same concept can be used to purchasing a short-term bond or fixed-income portfolio that will not just provide you some growth however also protect you from the troubled nature of stock markets.

A high-yield savings account could be the finest option. Make sure it is insured by the Federal Deposit Insurance Coverage Corporation (FDIC) (most banks are) so that if the bank goes under, you will still have access to your cash as much as $250,000. Go Here For the Details need to know exactly how much you're spending every monthand where it's going.