Rollover 401(k) to Gold IRA - Instagram Things To Know Before You Buy

Some Known Details About Rollover a Precious Metals IRA - Accuplan Benefits Services

Do I Have to Pay Tax on Gold? If you buy gold and earn a profit, then yes, you will have to pay tax on your earnings. Gold is categorized as a collectible, such as art or antiques, and goes through a 28% tax. The Bottom Line Though 401(k) strategies do not permit the straight-out investment of gold, there are plenty of other methods to integrate direct exposure to gold in your portfolio.

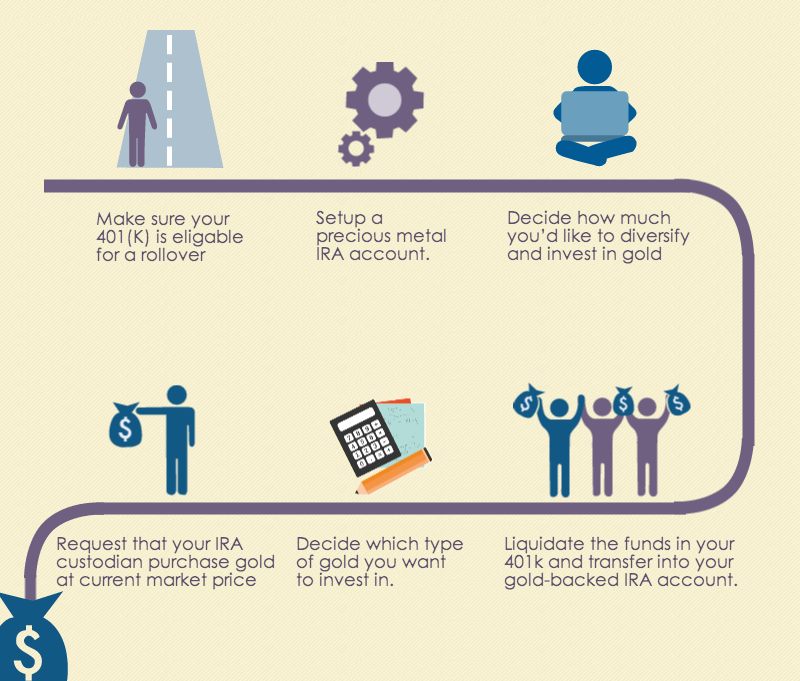

You can likewise roll over your 401(k) into a self-directed IRA under the permitted conditions where you can then invest directly in gold bullion and coins.

What is a Gold IRA Rollover? - Retirement Living - 2021

What is a Gold IRA Rollover? - Retirement Living - 2021Rumored Buzz on 401k gold ira rollover Archives - Provident Trust Group

As you continue to develop your 401K, you might begin to consider diversifying your portfolio. After all, you do not desire to deal with a stock exchange crash that might see your portfolio halve in less than one month. One of the most popular ways to safeguard your portfolio from market crashes is by adding rare-earth elements.

401k To Gold (IRA) Rollover Guide – Choose The Best Gold Company - SF Weekly

401k To Gold (IRA) Rollover Guide – Choose The Best Gold Company - SF WeeklyThat's where a comes in. When rolling over a 401K or pension to a Gold IRA, lots of questions may occur. That is why the executives at Obligation Gold will help address any concern that you may have and educate you on the significance of having a Gold individual retirement account. Here, we will have a look at how you can roll over your 401K into a Gold individual retirement account.

Gold IRA Rollover: 19 Essential Facts to Know Before You Invest Can Be Fun For Anyone

With a Gold IRA, you can hold gold bullion as well as silver, platinum, and palladium in your retirement portfolio and take pleasure in tax deferred advantages. However, be conscious that you can not consist of just any type of valuable metal in your. The bullion that you select for your Gold individual retirement account need to originate from an authorized list by the internal revenue service.

5% purity will certify for a Gold individual retirement account. Check For Updates of a Gold individual retirement account is that the precious metals need to be held by an approved custodian. That implies that the valuable metals are never ever in your direct belongings. The very first thing that you need to do is open an account with an approved custodian.

See This Report about Can I Rollover My 401k Into Gold - RC Bullion

Once you have opened the account, then you can acquire the gold or rare-earth element bullion for your Gold individual retirement account. Note that it is prohibited for you to take any ownership of the rare-earth element. For that reason, you can use a list of brokers supplied by the custodian to make your rare-earth element purchases.