More About PO Financing vsLine of Credit

PO/Factoring/Trade Finance - pbigloballending

PO/Factoring/Trade Finance - pbigloballendingThe Of PO Finance for Global Trade Companies - 1st Commercial

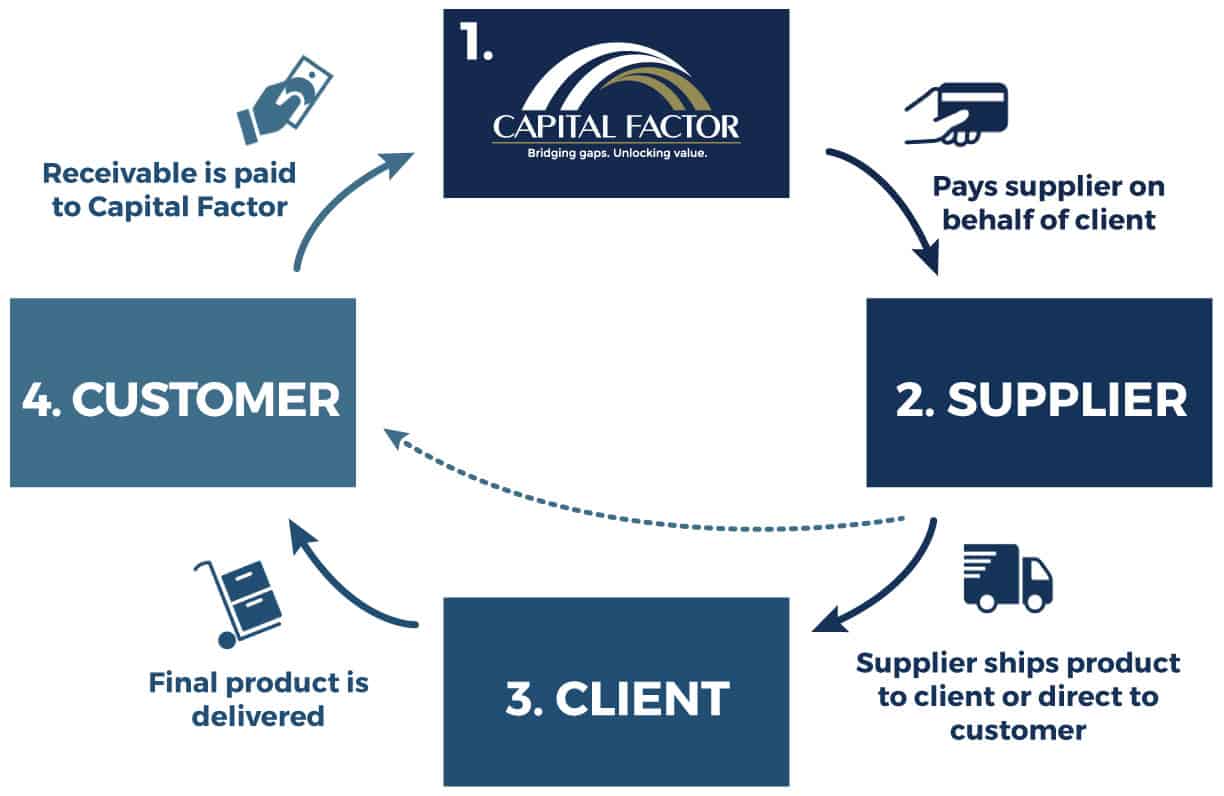

Sometimes, will fund an entire order while in other cases they might only finance a portion of it. When the supplier is ready to deliver the order, the order financing business gathers payment directly from the customer. After deducting their charges, the company then sends the balance of the invoice to your organization.

Regrettably, that's not constantly the case. The excellent news is that by utilizing PO loans to money order, suppliers can satisfy their consumers' needs while continuing to grow their operations. While small company owners utilized to expect standard banking institutions to fulfill their financing needs, banks are lending in the wake of the 20072008 financial collapse.

They just tend to be particular, choosing to lend to business that have near-perfect credit ratings that have actually been in service for a long period of time. Full Article financing companies, on the other hand, are willing to money providers even if they have less-than-ideal credit history. These lenders are more thinking about the credit reliability of the clients that send out in purchase orders.

Everything about How AR and PO Financing Work [Infographic] - Lendio

This is specifically advantageous to more recent companies that might have a large purchase order sprung on them when they're not ready for it. If you're a small company owner fretted about whether your company will have access to the money it needs to fulfill the next big order that comes in, PO funding may be just the solution you require.

Usually, the types of organizations that may utilize PO funding include: Distributors, Outsourcers, Resellers, Wholesalers, Companies with heavily seasonal sales patterns, Businesses with tight capital and a requirement to acquire materials prior to satisfying orders, How Line of Credit Is Utilized For PO Financing, Entrepreneur commonly utilize their organization line of credit as a tool to assist grow their company and achieve more, much faster.

Purchase Order Finance by Meridian PO Finance 866-988-6868

Purchase Order Finance by Meridian PO Finance 866-988-6868After inspecting with your provider, you realize you don't have adequate cash on hand to fulfill the order. You review your options and eventually decide to give purchase order financing a shot. Here's what takes place next: You reach out to the PO financing lending institution, sending along the order itself and your provider's quote.