An Unbiased View of Mutual of Omaha Mortgage Loan Officer

21 Best Las Vegas Mortgage Brokers - Expertise.com

21 Best Las Vegas Mortgage Brokers - Expertise.comThe Ultimate Guide To Family Mortgage Inc.

Furthermore, some lenders will likewise charge mortgage insurance coverage premiums, particularly for HECMs. In time, interest is added to the balance of your mortgage. Despite the fact that you don't need to pay the loan right away, the amount that you eventually owe grows gradually. Another factor to consider is that rates of interest for a reverse mortgage are variable.

This irregularity supplies more choices for homeowners on how to get their money through a reverse home mortgage. You can also discover reverse home loans, specifically HECMs, that provide set rates of interest. However, choosing this option suggests that you will generally take the loan as a swelling amount at the end. Furthermore, the quantity that you can borrow is frequently less than what you would be able to get with a variable rate loan.

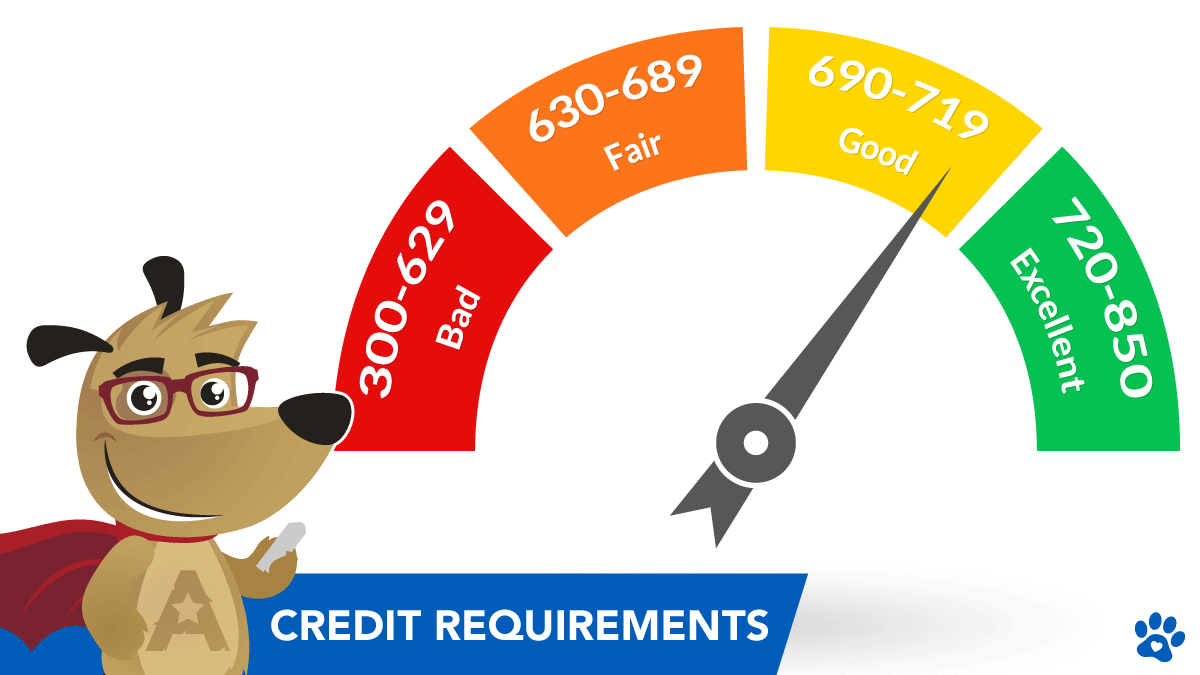

While you get to keep the title to your home with a reverse mortgage, you are generally accountable for other expenses connected with your house, such as utilities, home taxes, and insurance. How a Mortgage Lending Institution Might Help, A home loan lender carries out a financial evaluation that includes looking at your payment history, credit, and looking for exceptional mortgage.

6 Simple Techniques For Freedom Mortgage - #1 FHA and VA Lender in the U.S.

The lending institution will ask for to see income statements such as Social Security, pension payments, a 401(k), or pay stubs to validate that you can cover all real estate costs. Depending on your goals, a reverse home loan can be a fantastic way to earn additional money from your home equity. However, there's a lot to think about when choosing a reverse home loan.

Henry AThomas - Mortgage Loan Officer - Summit Funding, Inc- LinkedIn

Henry AThomas - Mortgage Loan Officer - Summit Funding, Inc- LinkedInCall the Drennen group! We are committed to supplying an incredible EXPERIENCE for YOU every day. Contact us with any questions about reverse mortgages in Las Vegas. Updated 1/15/21.

Las Vegas VA Home Loans • Blackmon Home Loans

Las Vegas VA Home Loans • Blackmon Home LoansWhat are reverse home loans? Read More Here , or Home Equity Conversion Mortgage (HECM), is a kind of house loan offered to homeowners 62 or older who have substantial equity (normally at least 50%) in their house. This financial tool can benefit people who require additional capital for other costs, as the value of their home's equity can be transformed to money, removing regular monthly home loan payments.