Some Known Questions About 3 Things Not to Do When Bitcoin is Going Down - Hacker Noon.

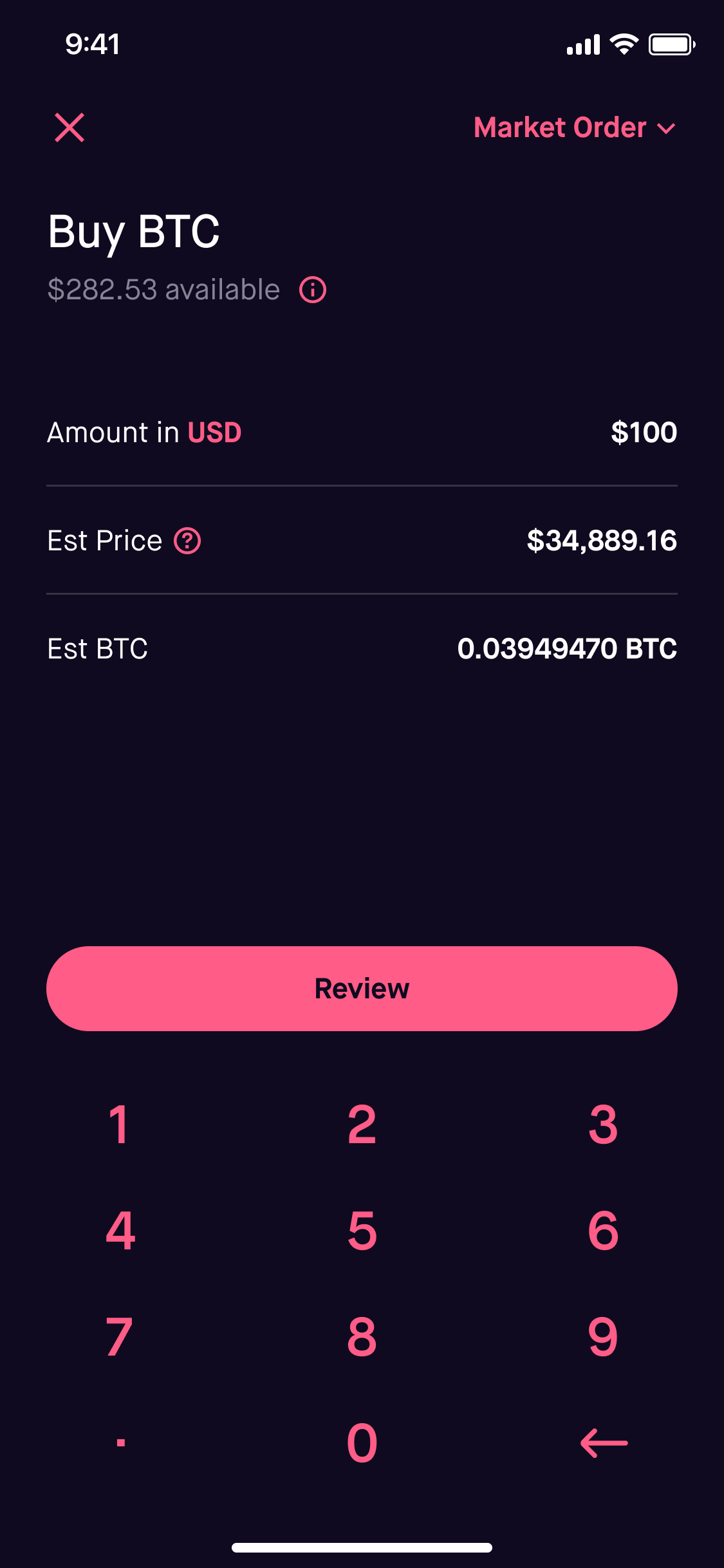

When is the best time to sell crypto? - Quora for Beginners

The smartness of a trader depends on interpreting these signals exactly as all indications have some disadvantages. For instance, a stochastic sign with a reading of over 80 suggests an overbought situation. However, if the indicator does not fall listed below 80 then the cost would continue to rise and offering Bitcoin at that time will be a bad idea.

Similarly, if the stochastic sign has a reading listed below 20 and the cost is trading listed below 200-day moving typical then a rebound will be temporary. On This Website , if the price is above 200-day moving average (as in the image above) then we can expect further gratitude in cost.

The green circle indicates the point where support levels have actually been checked and stochastic indicator is rising. That would be the finest entry point with minimum threat. When the stochastic indicator is listed below the reading of 20, the price has broken the support level temporarily. So, although stochastic indicator validates an oversold situation long positions need to be prevented.

How to Sell Bitcoin - Digital Trends

How to Sell Bitcoin - Digital TrendsExit based on stock chart patterns Rate volatility leads to formation of repetitive patterns in monetary markets. Such rate patterns can be determined using pattern lines. When a price pattern indicates a change in pattern, it is called as reversal pattern. Additionally, when a price pattern signifies a continuation of dominating trend, it is called as extension pattern.

What Does Cryptocurrency: When Is the Right Time to Buy? - The Motley Mean?

As humans unconsciously duplicate their previous behaviour, patterns get duplicated on charts. By recognizing those patterns, a trader can get in or exit the position before the break out in fact happens. Popular extension patterns it is drawn using two assembling trendlines, which are moving in different instructions (up trendline and down trendline).

it is drawn with 2 converging trendlines, which are angled either up or down. Unlike a pennant, both trendlines indicate the very same direction in a wedge pattern. Turnaround Patterns it appears at market tops. The pattern is comprised of an initial peak, followed by a bigger one. The final peak imitates the first.

3 Ways You Can Sell Your Bitcoin Into Cash: A Quick Guide from Binance - Binance Blog

3 Ways You Can Sell Your Bitcoin Into Cash: A Quick Guide from Binance - Binance BlogInverse head and shoulders results in a bullish break out. 2 unsuccessful attempts to break a cost level (resistance) results in the formation of a double top pattern, which looks like alphabet'M'. Two unsuccessful efforts to break a rate level (assistance) results in the development of a double bottom pattern, which frequently appears like alphabet 'W'.