Our Rick RRodriguez, CRMP® - Branch Sales Manager, Certified Statements

Find Mortgage Lender in Clark County, Nevada - a la mode Things To Know Before You Buy

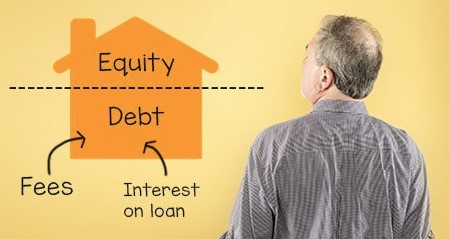

Since of the unusual payment terms, a reverse mortgage might not be a good option for a property owner who wants to hand their home to their kids, or who would like to leave the money from their house sale for their successors. The reverse home mortgage is a good choice for a property owner who does not have beneficiaries or who does not prioritize leaving an inheritance, and who does need to supplement their set income with equity from their home.

Links – Steve Elman * Reverse Mortgage Specialist

Links – Steve Elman * Reverse Mortgage SpecialistHomeowners who desire to keep as much inheritance for their kids as they can might need to check out other loan choices. Working with a financial consultant and a lending institution is a great way to check out those options. What Can Reverse Mortgages Be Used For? Spanish Hills property owners get reverse mortgages for various reasons.

In this case, the loan concerns the property owner in month-to-month installments. Need More Info? , property owners use a lump amount from their reverse home loan to make a major purchase or house upgrade. Some reverse home loans can only be utilized for a single function that is established at the time when the house owner looks for the loan.

The 5-Minute Rule for Reverse Mortgages

Various lenders might use various loan bundles at various rates. It is very important for homeowners who want a reverse mortgage to go shopping around till they find a mortgage that works for their requirements. If you're a property owner who desires to get a reverse mortgage, contact a trustworthy lending institution in your location.

For informational purposes only. Constantly seek advice from a certified home mortgage professional prior to proceeding with any realty deal.

How to Know if a Reverse Mortgage is Right for You

How to Know if a Reverse Mortgage is Right for You Reverse Senior Loans - Cape Cod Real Estate Lifestyle

Reverse Senior Loans - Cape Cod Real Estate LifestyleIn 2017, the national average for house equity gain per household significance how much the equity had risen from the previous year was $15,000. In Nevada, the typical equity gain per household was $27,000, or nearly twice the national average. Just California and Washington saw sharper increases. Nevada is booming again, particularly in metropolitan areas such as Las Vegas.

How Reverse Mortgages Fraud - Nevada Consumer Affairs can Save You Time, Stress, and Money.

There are lots of elements to consider when choosing if a reverse home loan is the very best choice for you, including: Eligibility. Not everyone gets approved for a reverse home loan. You should be 62 or older and own your house. Even then, other requirements might use. Financial need. If you have medical or other debts to pay off, taking advantage of your house equity can be beneficial.