About New Paycheck Protection Program (PPP) Loans - SCORE.org

Facts About Paycheck Protection Program - SBA Revealed

75% of $25 per hour = $18. 75. b. The pay Worker A received throughout the covered duration of $15 per hour is $3. 75 less than $18. 75. 2. Because Staff member A is per hour, debtors will require to determine the typical variety of hours worked weekly in between Jan.

a. Presume for 3 way funding , the typical number of hours worked weekly is 40. 3. To compute the salary/wage decrease, which will reduce a debtor's loan forgiveness, increase the decrease by the average hours worked each week times the variety of weeks in the covered period. a. $3. 75 salary/wage reduction 40 hours 24 weeks = $3,600.

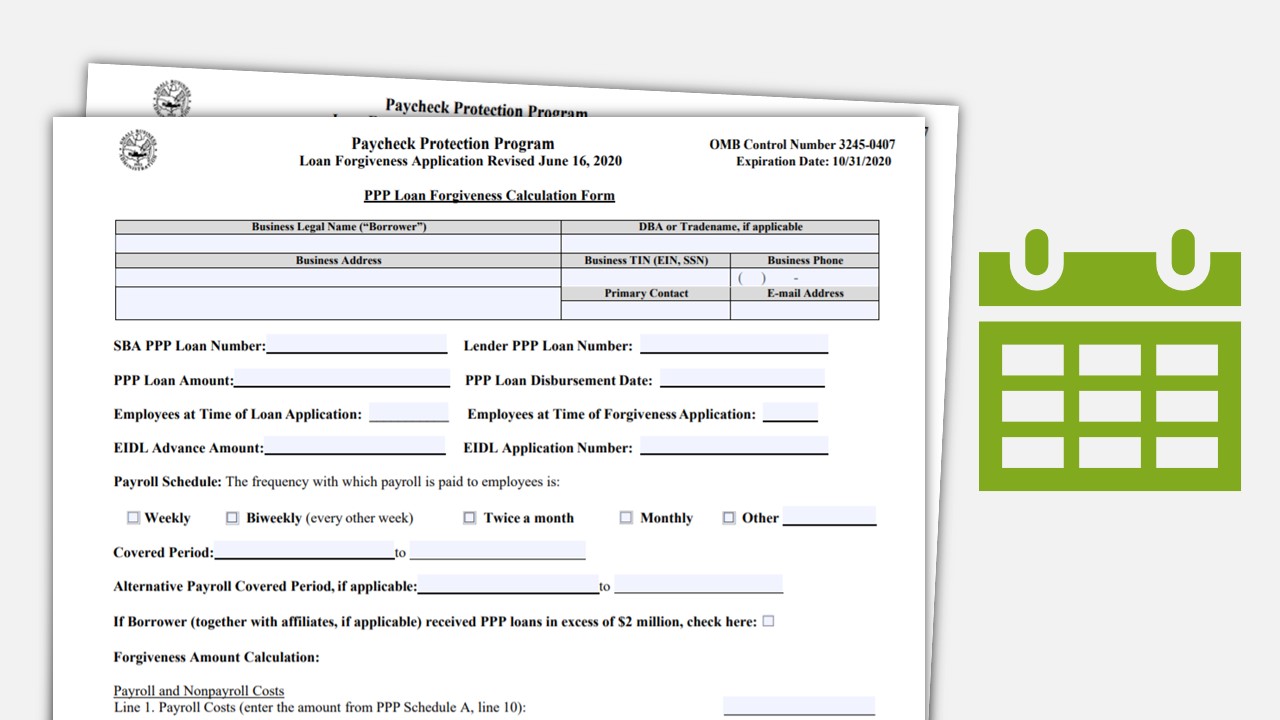

The application did not specify owner-employees, triggering an excellent quantity of confusion. A FAQ released in early August defined an owner-employee as somebody who is both an owner and a staff member of a C corporation. An interim final rule provided Aug. 24 established that the PPP owner-employee compensation guideline does not apply to people with less than a 5% stake in a C or S corporation.

Paycheck Protection Program - How it Works - Funding Circle

Paycheck Protection Program - How it Works - Funding CircleThe 6-Minute Rule for Paycheck Protection Program Resources - Senate Small

Those with less than a 5% ownership in an S or C corporation will be eligible for the staff member compensation optimum of $46,154 instead of the owner-employee maximum of $20,833 throughout a 24-week covered duration. Please note that partners are still subject to the $20,833 constraint for a 24-week covered period.

Let's close this short article with a couple of suggestions on what Certified public accountants can do now: Document whatever you can: Because the guidelines for PPP loan forgiveness include numerous gray areas, customers need to know how they reached certain conclusions and what guidance they used to do so. Document how a conclusion was reached and the place of the guidance that informed that conclusion.

PPP Loan Forgiveness and FAR “Credits” for Government Contractors - GRF CPAs & Advisors

PPP Loan Forgiveness and FAR “Credits” for Government Contractors - GRF CPAs & AdvisorsIn the event you need to find something you didn't previously think pertained to your situation, have a look at the Resource Index of IFRs and Frequently asked questions at (AICPA member login needed for gain access to). Exercise your finest judgment: This can not be worried enough. Customers and their advisers require to be conscious of the guidance, checked out the application and application guidelines completely, and utilize that details to come to a sensible conclusion.