Some Known Details About COVID-19 EIDL Updates - Maximum Loan Amounts - OH IN KY

EIDL 2.0 News 2021 - Major Changes On How to Use SBA EIDL Loan Funds - FreedomTax Accounting, Payroll & Tax Services

EIDL 2.0 News 2021 - Major Changes On How to Use SBA EIDL Loan Funds - FreedomTax Accounting, Payroll & Tax ServicesA Biased View of COVID EIDL Loans Information as of September 8, 2021

However, the number of employees is greater for companies in some industries. The SBA Table of Small Company Size Standards programs whether your industry permits more workers. Referrals to alternate usage of receipts (earnings) instead of variety of workers do not get the COVID-19 EIDL. Area and organization type standard Since the coronavirus (COVID-19) pandemic applies to all 50 U.S.

BIG ANNOUNCEMENT: EIDL LOANS ARE BACK OPEN » Succeed As Your Own Boss

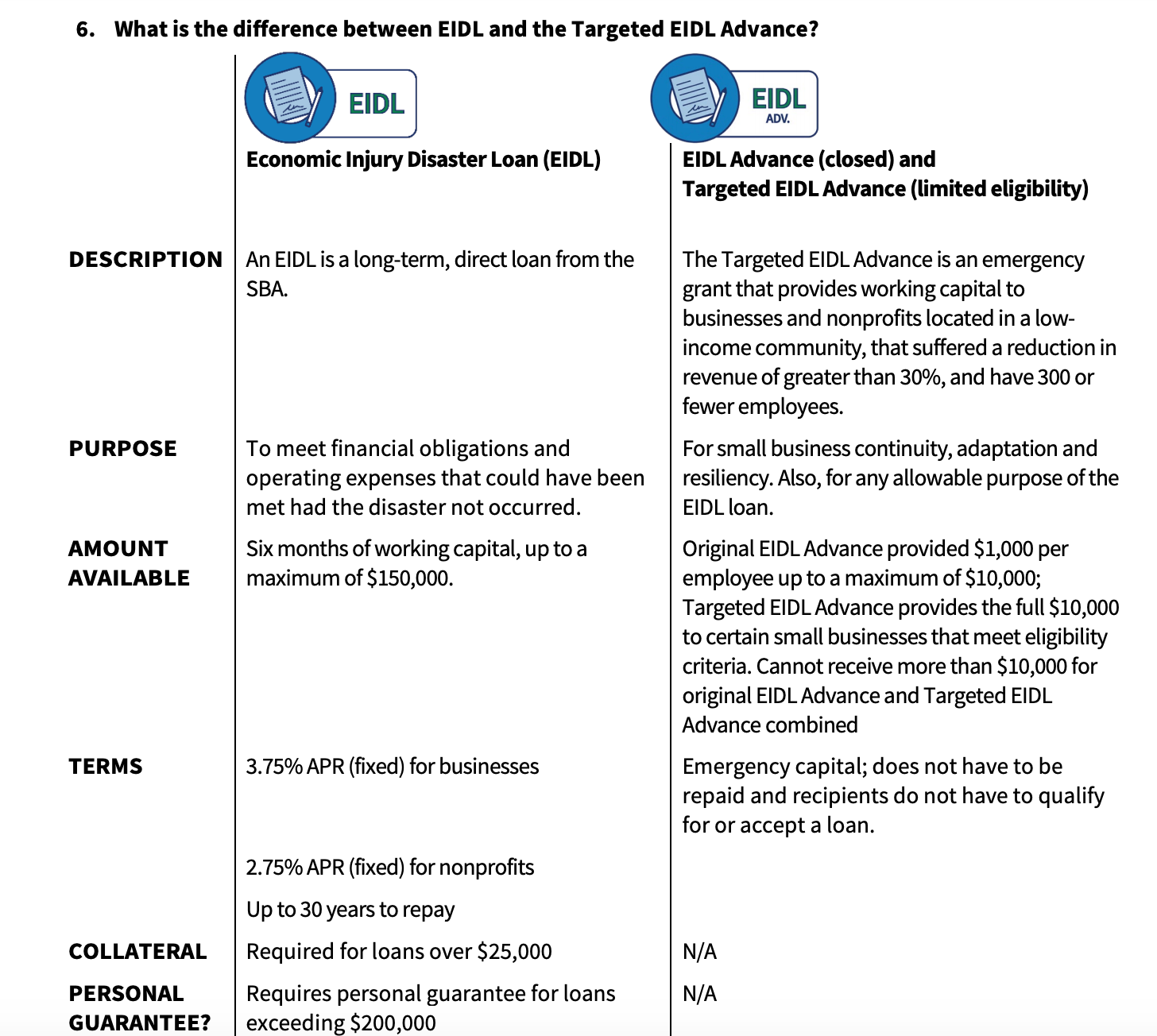

BIG ANNOUNCEMENT: EIDL LOANS ARE BACK OPEN » Succeed As Your Own Bossareas, practically any small organization in the United States and its areas certifies by place. In addition to what many people would consider an organization, these standards and loan availability choices likewise use to sole proprietorships, independent professionals, and self-employed individuals. Loan Approval Conditions The list below loan approval conditions reflect some relaxing of traditional EIDL specifications: You can obtain as much as $200,000 without a personal guarantee.

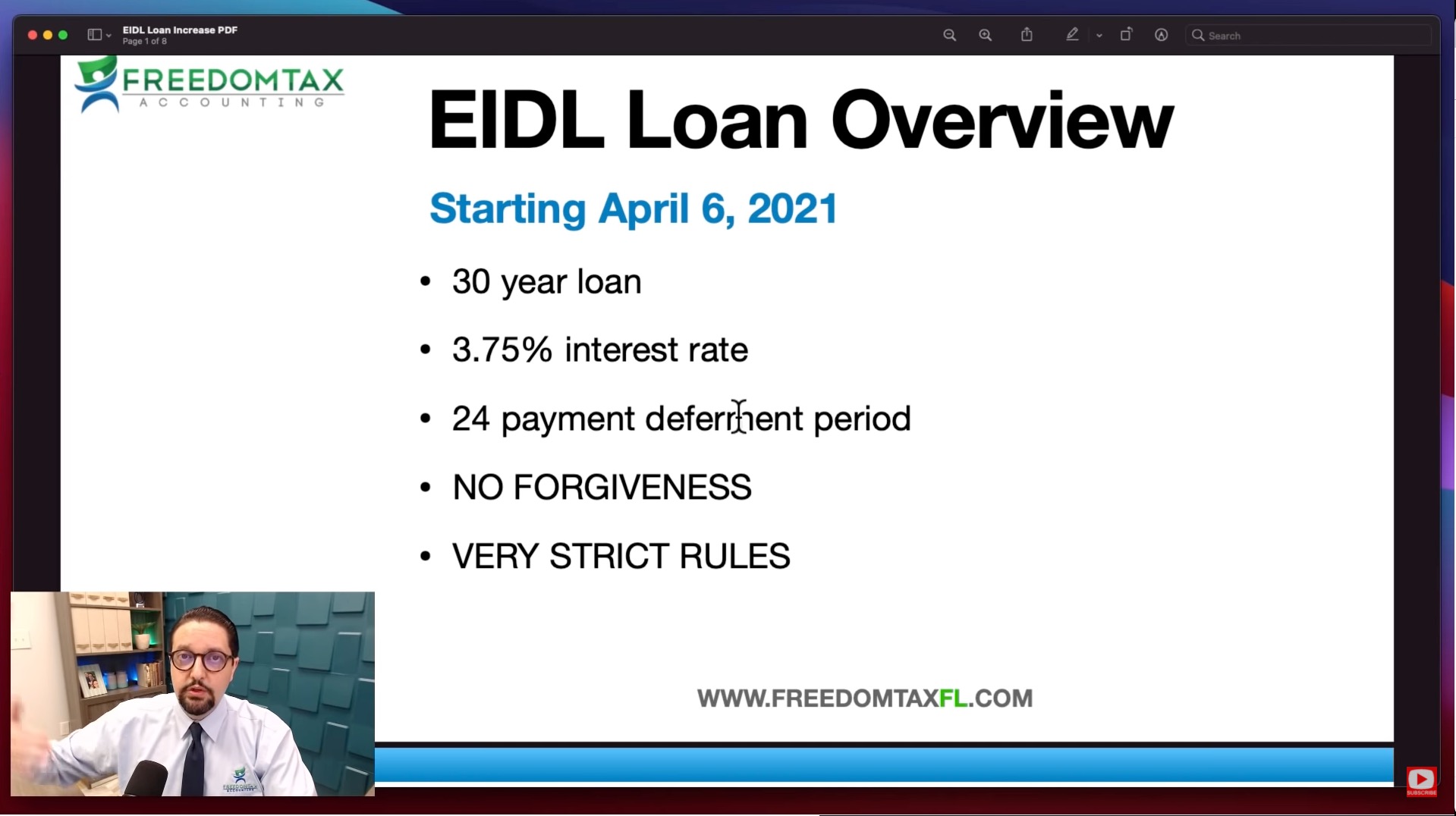

You do not need to prove you could not get credit somewhere else. Loans of $25,000 or less require no collateral. For loans above $25,000, a basic security interest in service properties can be utilized. You must permit the SBA to review your business tax records. April 6, 2021 As of this date, EIDL loans approximately $500,000 covering 2 years of financial difficulty are available.

Maximum EIDL Loan Amount Raised to $500,000 - Hoffman Group

Maximum EIDL Loan Amount Raised to $500,000 - Hoffman GroupSince April 6, 2021, you can obtain an EIDL of as much as $500,000 covering 24 months of financial injury to pay expenditures such as set debt and payroll costs. Some loans processed prior to that date might be qualified for an increase, and the SBA will notify those borrowers.

The Ultimate Guide To SBA Increases COVID EIDL Cap, Expands Use of Funds - - CBIA

75% (2. 75% for nonprofits) and the loan term can be for as long as thirty years. The COVID-19 EIDL includes an automated one-year deferment on payment, though interest starts to accumulate when the loan is disbursed. If you receive and receive a Targeted EIDL Advance, the funds you receive are totally forgivable.

The section below entitled New Targeted EIDL Advance provides extra information on the brand-new advance program including conditions under which you may qualify. Streamlined Application EIDLs are moneyed by the SBA, so you make your application with the SBA. For Additional Info -19 variation of the EIDL, the application process has actually been streamlined; the SBA says it should take you 2 hours and 10 minutes or less to complete the application.