The 7-Second Trick For Jumbo Loans: What You Need to Know - NerdWallet

What Is A Jumbo Mortgage Loan?Jumbo loan is one way to buy a… - by Krisanta Alexandra Ropati - Medium

What Is A Jumbo Mortgage Loan?Jumbo loan is one way to buy a… - by Krisanta Alexandra Ropati - MediumThe Main Principles Of Jumbo Mortgage Rates - Jumbo Loans - Guaranteed Rate

Paperwork, To show your monetary health, you'll need substantial documentation, possibly more than for an adhering loan. You should be prepared to turn over your full tax returns, W-2s and 1099s when applying, in addition to bank statements and info on any investment accounts. Appraisals, Some lending institutions might need a second home appraisal for the residential or commercial property you're planning to acquire.

Jumbo Loans - Connecticut Mortgage Broker - NimaLoans

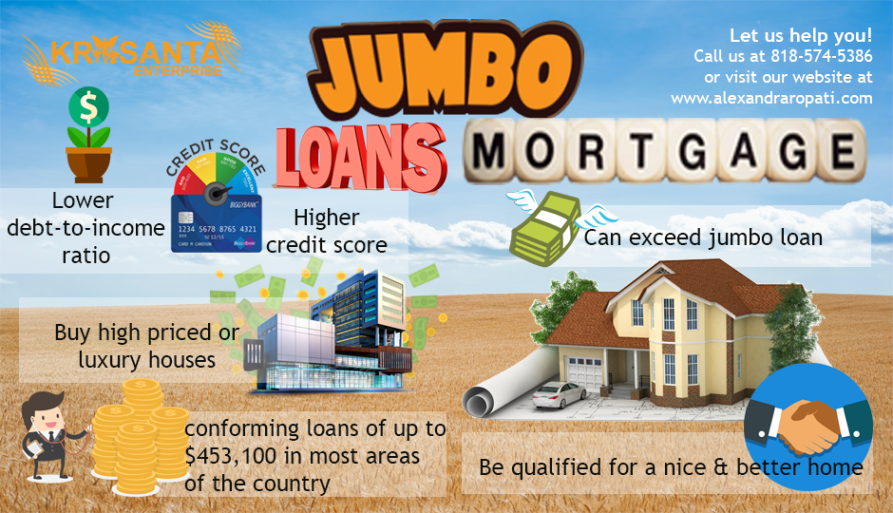

Jumbo Loans - Connecticut Mortgage Broker - NimaLoansconforming loans, The crucial distinction between a jumbo home mortgage and a conforming loan is the size of the loan. For The Most Complete Run-Down at the two, and the benefits and drawbacks of each, check out the distinctions in between adhering and nonconforming loans. Amongst the other elements that differentiate jumbo loans from conforming loans: Heftier down payment, While low down payments are fairly common on conforming loans, jumbo loans are more likely to require a down payment of at least 20%, though some lending institutions may go as low as 10%.

Jumbo Loan - Delta Community Credit Union

Jumbo Loan - Delta Community Credit UnionNevertheless, numerous lending institutions can provide jumbo loan rates that are competitive with rates on adhering loans and some might even use slightly lower rates depending upon market conditions, so make sure to shop around. Greater closing expenses and fees, Since jumbo loans are bigger and there are some additional certifying actions, anticipate greater expenses at the closing table.

Not known Facts About Jumbo Mortgages: Limits, Rates & More

For 2021, the conforming loan limitation for one-unit houses in the majority of counties across the country is $548,250. However, in "high-cost locations," especially in the Northeast and on the West Coast, adhering loan limitations are expanded to $822,375 and even greater in a couple of other locations.