The Best Guide To Comparing Mortgage Rates in Roseville, CA - Wirefly

The Greatest Guide To RPM Mortgage: We Get You Home On Time®

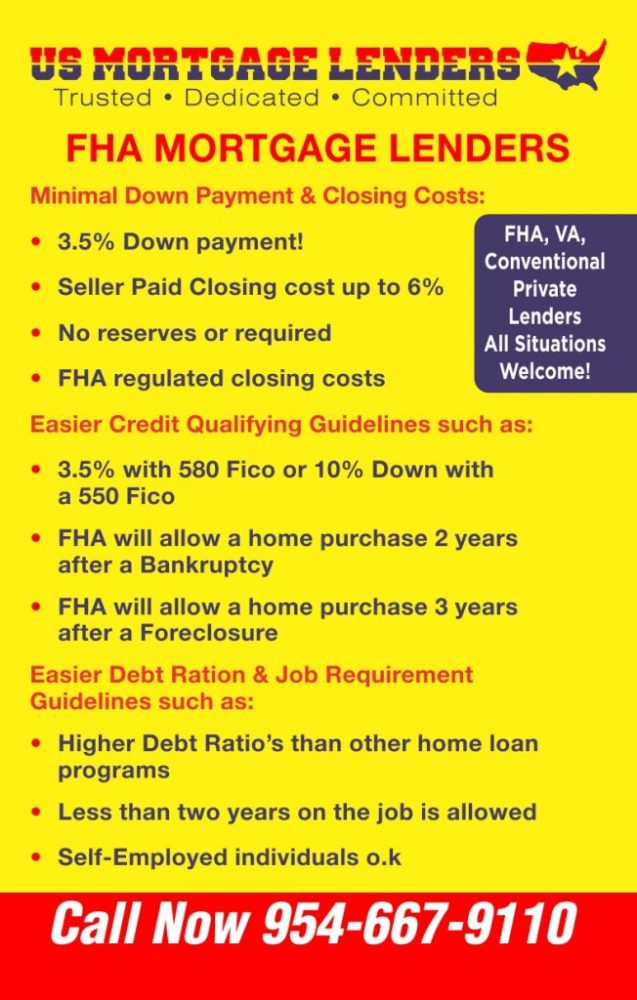

FHA loan quick view Deposit as low as 3. 5% Low credit report qualifying No income limits Permits a non-occupant co-borrower to assist you qualify 6% optimum seller contribution Residence should satisfy HUD guidelines Home mortgage insurance coverage required and might be financed into the loan. Low closing costs Flexible requirements Your Customized FHA Loan Rate Start your free quote from Mann Home loan How are FHA loans various from conventional loans? FHA loans have actually more relaxed credentials requirements than standard home loans, making it easier for many borrowers to qualify.

5% deposit to certify. This Is Noteworthy with a lower rating of 500 579 might even qualify with a higher minimum down payment of 10%. Are FHA loans just for first-time home purchasers? No! Considering that numerous novice homeowners have low credit and little down payments, FHA loans are an excellent fit.

Getting The FHA Loan Limits for CALIFORNIA To Work

Advantages of an FHA loan The lower credit rating minimums and higher debt-to-income ratios utilized to certify borrowers for FHA loans make them an attractive option to lots of home buyers. The down payment requirements are low (as low as 3. 5%) and the money can originate from a gift from a household member or through a grant something standard loans won't enable.

U.SBank Mortgage - Sean Gebauer - Roseville, CA

U.SBank Mortgage - Sean Gebauer - Roseville, CA5% down payment to quality for an FHA loan. No matter just how much you have for a down payment, you'll still need to pay both an in advance and yearly mortgage insurance coverage premiums (MIPs). The one-time upfront MIP payment is equal to 1. 75% of the loan amount and you can fund it into the loan.

The Best Lenders for FHA Loans in September 2021

The Best Lenders for FHA Loans in September 2021Everything about Roseville - Summit Funding Inc.

45% to 1. 05% of the base loan quantity and will last either 11 years or the life of the loan depending upon the length of the loan and the amount of down payment made. The loans can only be utilized for main house realty. Who should think about an FHA loan? Debtors interested in purchasing a home with low credit report who can handle a minimum of a 3.

Nevertheless, due to the monthly MIP payments, those with significant deposits or higher credit ratings may be much better off going with a traditional mortgage. Talk to a regional mortgage lending institution to see whether a conventional or FHA loan would be best for your distinct monetary circumstance. If you have an interest in buying or refinancing a home in Roseville or accross Minnesota, Mann Home mortgage can assist you make it happen.