Unknown Facts About Foreign Currency Exchange Rates and Currency Converter

Foreign Exchange (Forex) - TradeStation Things To Know Before You Buy

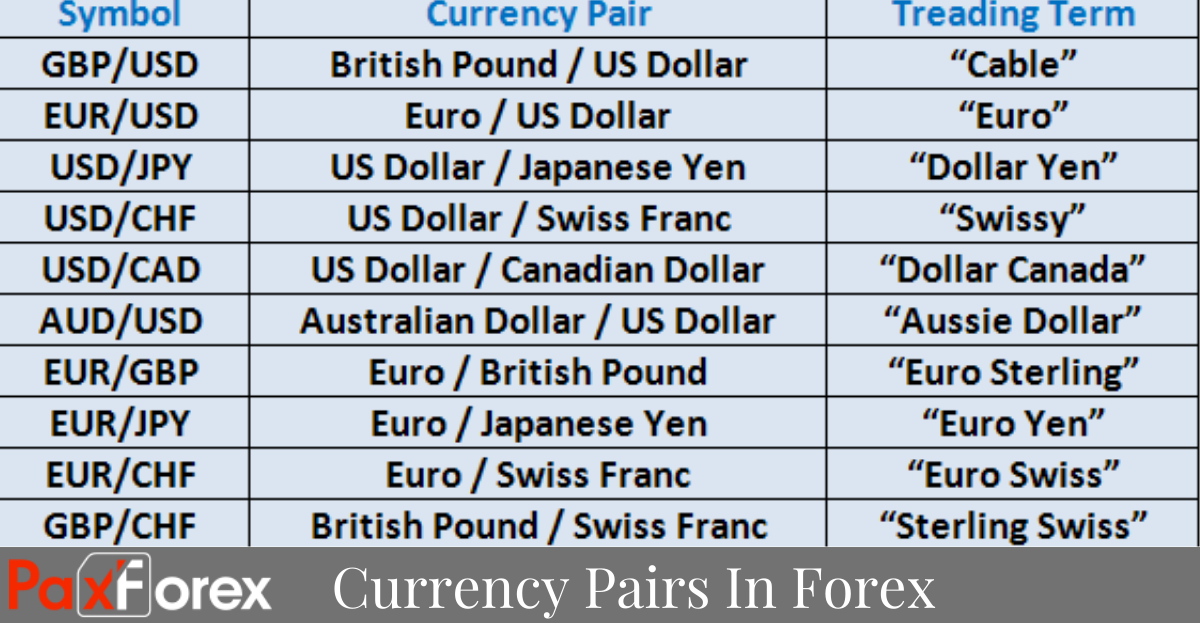

trading day ends, the forex market starts once again in Tokyo and Hong Kong. As such, the forex market can be very active whenever of day, with cost quotes altering constantly. A Quick History of Forex In its a lot of basic sense, the forex market has been around for centuries. Individuals have constantly exchanged or traded goods and currencies to acquire goods and services.

Foreign Exchange (Forex) Definition

Foreign Exchange (Forex) Definition UnoForex - Money Exchange, Money Transfers, Exchange Rate - (212) 279-6150

UnoForex - Money Exchange, Money Transfers, Exchange Rate - (212) 279-6150After the Bretton Woods accord began to collapse in 1971, more currencies were enabled to drift freely versus one another. The worths of individual currencies vary based on demand and circulation and are monitored by foreign exchange trading services. Industrial and financial investment banks carry out the majority of the trading in forex markets on behalf of their clients, but there are also speculative opportunities for trading one currency versus another for professional and specific financiers.

Prior to the 2008 monetary crisis, it was extremely common to short the Japanese yen (JPY) and purchase British pounds (GBP) since the interest rate differential was large. This strategy is sometimes referred to as a "bring trade." Why we can trade currencies Currency trading was extremely hard for private financiers prior to the Web.

2021 Forex Trading Statistics + Industry Guide [Fact Checked]

2021 Forex Trading Statistics + Industry Guide [Fact Checked]With assistance from the Internet, a retail market focused on specific traders has emerged, providing easy access to the foreign exchange markets through either the banks themselves or brokers making a secondary market. Many online brokers or dealerships use very high take advantage of to specific traders who can manage a big trade with a little account balance.

Little Known Facts About Currency Exchange - Fidelity Investments.

It is the only genuinely constant and nonstop trading market in the world. In the past, the forex market was dominated by institutional firms and large banks, which acted on behalf of clients. But it has actually become more retail-oriented over the last few years, and traders and investors of numerous holding sizes have actually begun taking part in it.

Rather, it is a series of connections made through trading terminals and computer networks. Individuals in this market are institutions, financial investment banks, business banks, and retail investors. Also Found Here is considered more opaque than other financial markets. Currencies are sold OTC markets, where disclosures are not obligatory.