Some Known Details About Inaccurate Zillow 'Zestimates' a source of conflict over home

Zillow Surfing Is the Escape We All Need Right Now - Truths

Realty listings website Zillow has simply priced its IPO at $20 per share, offering the company a $539 million assessment. Recently, the company upped the pricing of its IPO to $16 to $18 per share, from the preliminary variety of $12 to $14 per share. Zillow, which will begin trading under the symbol "Z" on the NASDAQ tomorrow morning, will raise as much as $79.

The variety of modifications in Zillow's rates (and the stable increase in share worth pre-IPO) resembles Linked, In and Pandora's prices boosts. These business saw changes in the share value post-IPO (though both business have rebounded in July). Other tech companies like Home, Away, Fusion-IO and Yandex didn't post a number of altered in pre-IPO prices and have actually seen stable share values.

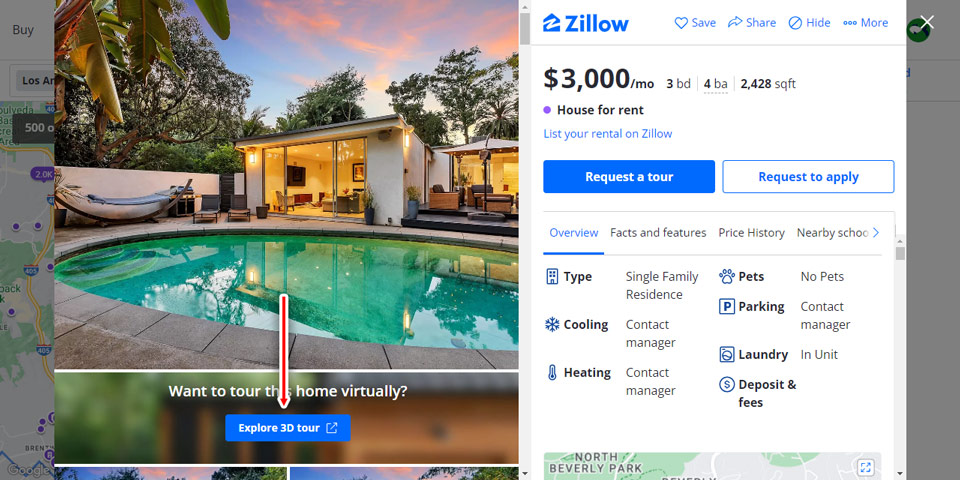

Browsing houses on Zillow is the newest pandemic pastime

Browsing houses on Zillow is the newest pandemic pastimehomes, consisting of homes for sale, homes for lease and houses not presently on the market. Zillow released a mortgage marketplace in 2008, and subsequently broadened into leasings and mobile. According to Experian Hitwise, is the 3rd most checked out Property website in the U.S and received 5. 36% of Property visits in March 2011, which is a 53% boost compared to March 2010.

Are Zillow Zestimates Accurate? Truth on Real Estate Estimates

Are Zillow Zestimates Accurate? Truth on Real Estate EstimatesThis could be a consider how the market reacts to Zillow tomorrow morning. Underwriters for the include Citi, Allen & Company, Pacific Crest Securities, Think, Equity LLC, and First Washington Corporation.

The Best Strategy To Use For Zillow - Crunchbase Company Profile & Funding

If you're uncertain where to begin when looking for the next multi-bagger, there are a few essential patterns you ought to keep an eye out for. One common method is to attempt and find a company with returns on capital utilized (ROCE) that are increasing, in conjunction with a growing quantity of capital employed.

So when we looked at (NASDAQ: ZG) and its pattern of ROCE, we really liked what we saw. Comprehending Found Here On Capital Employed (ROCE) For those who do not know, ROCE is a measure of a company's yearly pre-tax revenue (its return), relative to the capital utilized in the organization. Analysts utilize this formula to calculate it for Zillow Group: 0.