Some Known Incorrect Statements About The Top Nine Best and Most Affordable Reverse Mortgage

Facts About Reverse Mortgage Bank in Reno Nevada Helping Seniors Uncovered

If an individual's health decreases to the point where they must move to a treatment center, the loan must be paid back in complete, as the house no longer qualifies as the debtor's main residence. Moving into a retirement home or a nursing home for more than 12 consecutive months is considered a permanent relocation under reverse home mortgage regulations.

4. You Might Move Quickly If you're considering moving for health issues or other reasons, a reverse mortgage is most likely reckless due to the fact that in the short-run, high up-front costs make such loans financially unwise. These costs consist of loan provider costs, preliminary mortgage insurance coverage expenses, continuous home loan insurance coverage premiums, and closing (a. k.a.

Certified Reverse Mortgage Professional®, Rick RRodriguez - Fairway Mortgage

Certified Reverse Mortgage Professional®, Rick RRodriguez - Fairway MortgageOur Rick RRodriguez, Certified Reverse Mortgage Professional Statements

Property owners who all of a sudden leave or sell the residential or commercial property have simply 6 months to repay the loan. And while borrowers might pocket any sales earnings above the balance owed on the loan, countless dollars in reverse home loan costs will have already been paid out. 5. You Can't Afford the Expenses Reverse mortgage proceeds might not suffice to cover home taxes, homeowner insurance premiums, and house maintenance expenses.

Reverse Mortgage Funding - National Mortgage Lender - RMF

Reverse Mortgage Funding - National Mortgage Lender - RMFOn the brilliant side, some regions provide real estate tax deferral programs to assist elders with their cash-flow, and some cities have actually programs tailored towards helping low-income elders with home repair work, however no such programs exist for house owner's insurance. The Bottom Line If you're cash poor, however a reverse home mortgage seems like problem, there are other choices, such as offering your house and downsizing to smaller and less expensive ones.

Some Known Questions About Reverse Mortgage Scams — FBI.

Other possibilities include seeking home equity loans, home equity lines of credit (HELOC), or refinancing with a conventional forward home mortgage.

In 2017, the nationwide average for home equity gain per household meaning just how much the equity had increased from the previous year was $15,000. In Nevada, the average equity gain per household was $27,000, or nearly two times the nationwide average. Just California and Washington saw sharper increases. Nevada is expanding once again, particularly in city locations such as Las Vegas.

All about George Lagarde - Reverse Mortgage Advisor - Finance of

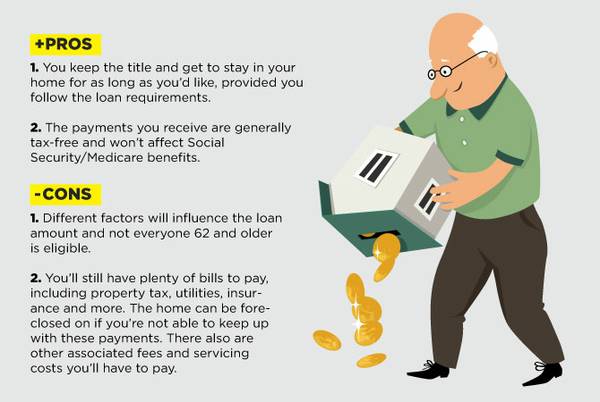

There are numerous aspects to consider when choosing if a reverse mortgage is the best decision for you, consisting of: Eligibility. I Found This Interesting qualifies for a reverse home loan. You need to be 62 or older and own your house. Even then, other requirements may use. Financial requirement. If you have medical or other debts to settle, using your house equity can be beneficial.